Hi, I’m Colin Platt, co-host of the Blockchain Insider podcast, and a cryptocurrency and distributed ledger researcher and specialist. Zeth, Shaun and I started discussing how to delve into a series of topics that we found interesting –and perhaps less well covered– in and around the cryptocurrency/blockchain space, a few months ago. We think we came up with a good formula to get started, and we hope that you enjoy this series of fortnightly posts, and of course welcome your feedback.

Hindsight is 20/20 of course, but by now it is quite obvious that the H2 run-up in cryptocurrency prices and flurry of ICO raises was unsustainable. At the time of writing, Bitcoin is down nearly 70% from its December 2017 all-time highs, and Ether is down more than 85% from an all-time high in January 20181. Though hardly dead, the total amount of funding for ICOs has seen a nearly 80% fall from its peak in December 2017 of $1.66 million raised, down to $337 million in August 2018 according to icodata.io.

Though there may be blood in the proverbial streets of crypto, one meme that seems to live on in the cryptocurrency space is that when markets are down, people build. So let’s have a look at whether there is any merit to this.

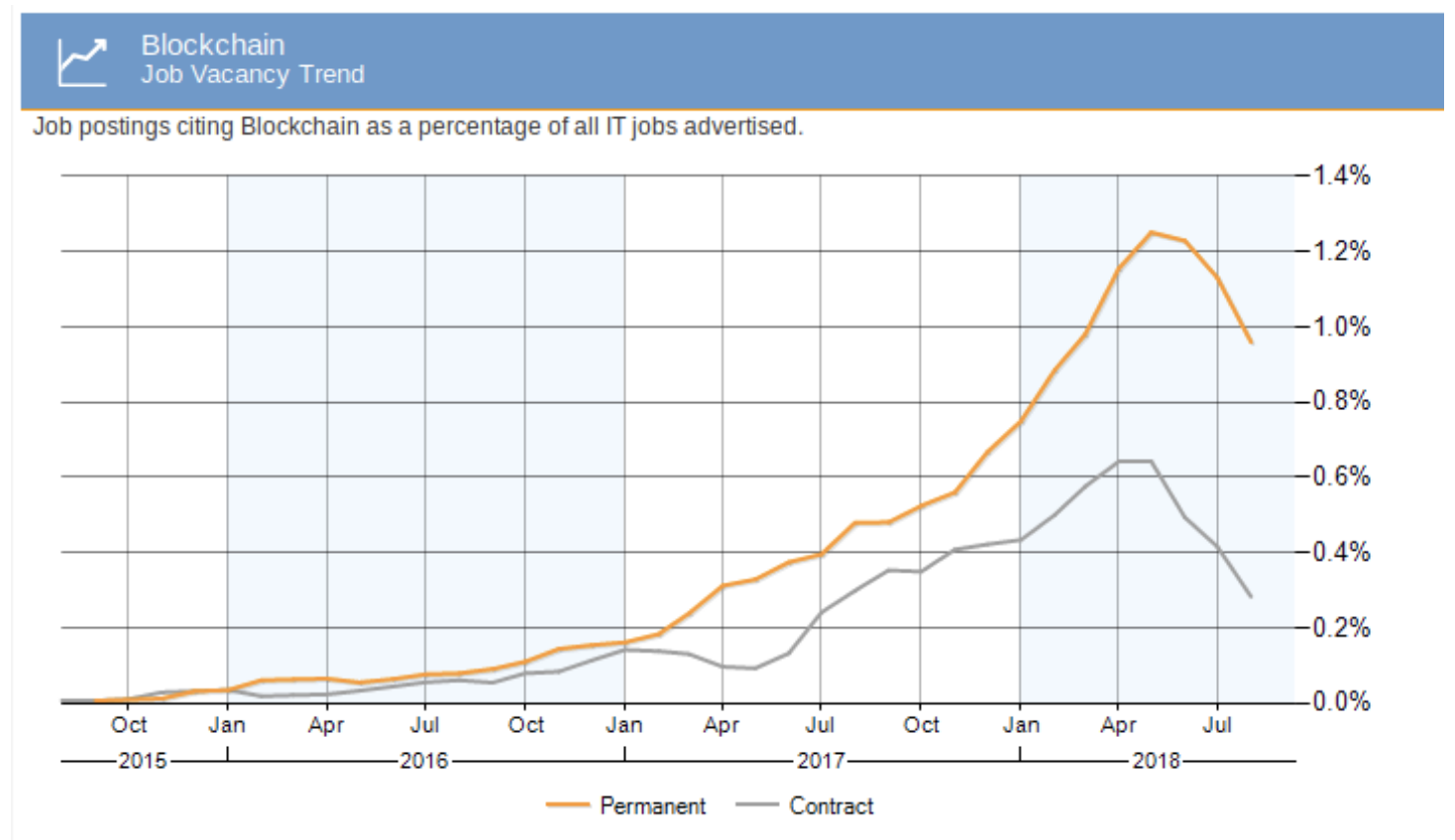

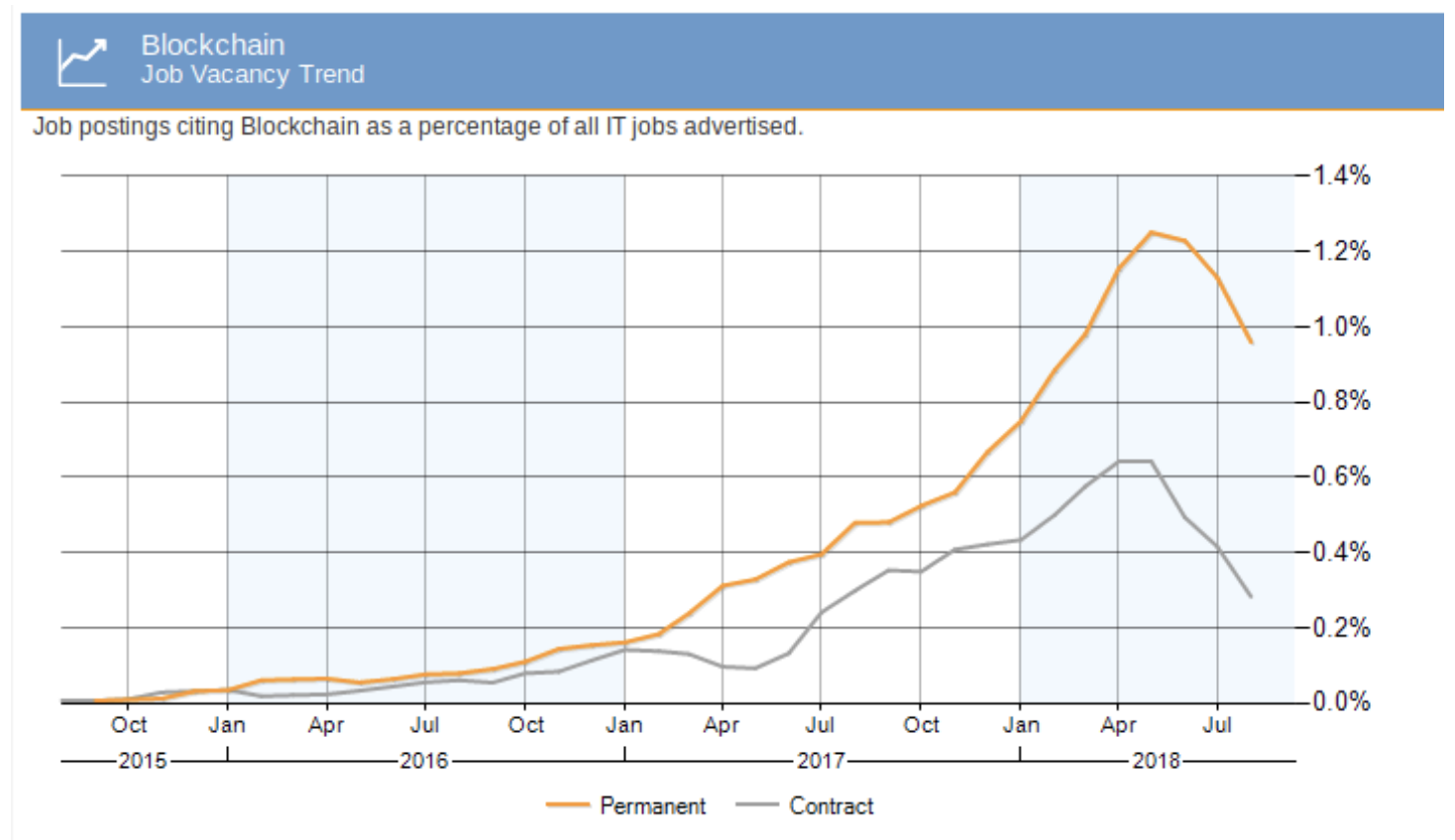

To start answering this question, I headed over to ITJobswatch, they have some interesting tools to analyse the trends of the IT jobs markets. Their dataset is UK-centric, but it gives an interesting indications of what is happening. We can see in the graph below that jobs vacancies for permanent roles citing “Blockchain” somewhere in the description:

This number peaked in May of this year, accounting for more than 1.2% of all IT jobs at the time. This number has dropped, currently representing roughly 1% of all permanent IT jobs. Contract roles have been slightly more volatile, peaking at about the same time at 0.7% of contract IT jobs, but dropping roughly 60% to 0.3% in August. Perhaps unsurprisingly 80% of these jobs are currently concentrated around London.

We also know that people are skilling up. With sustained interest in the space this should come as no surprise. But what is quite interesting to ponder, is that even if the price of cryptocurrencies has dropped, a lot, recently they are still up, a lot… What this means is that many people that have been in it for awhile are financially independent enough to do their own thing. This leaves a void for strong talent to acquire the skills and move into project, some of them possibly led by these early adopters. Another thing that we are seeing is that the new crop of talent, who may not come from a cryptocurrency background but industry bring in a strong background that complements the team. This is critical for a lot of projects that want to change industry, but don’t necessarily know the finer details of building production software in that industry.

What can we glean from all this?

From speaking with people in the business, it is clear that companies are still recruiting, and that there is a serious talent gap. The ability for indiscriminate fundraising at incredible levels may have gone away, but there are two clear positives.

Firstly, there are potentially fewer low quality projects raising money in the ICO space for blockchain projects with little to no technical justification for using these technologies and an equally slim chance of any meaningful success. The second is that the many of the more promising projects that have weathered the storm, practiced good treasury management and have a clear path forward are still hiring, and they need the best to deliver on their ambitions. They also appear to be paying up, median salaries for blockchain roles have increased by roughly 11% since this time last year.

On the enterprise and non crypto side of blockchain, the hype phase seems to have died as well. Anecdotal evidences suggests that a lot of the proofs-of-concept popular in 2016 and early 2017 have proven to be less efficient than more traditional implementations. As a result companies have become more focussed on quality projects and doubled down on working towards implementation rather than simply exploration. Returning to the numbers, perhaps a lot of the jobs that weren’t really focused on blockchains but just cited them have been taken off the table.

Another promising sign in the enterprise blockchain space is that several of the code bases are starting to mature and become stable enough to actually envisage using them in production. From Corda, to Hyperledger to Enterprise Ethereum, companies have stopped becoming involved simply for the press release factor, but because of an actual conviction that these can be useful. We’ve seen a series of successes coming not only from larger household name companies, but small providers who need to deliver solutions that directly leverage these technologies.

Bottom line is, after the hysterical days of crypto in late 2017, talented people that can deliver are back in vogue. There is still a lot of work to be done, but plenty of investment and willingness to pull it off.