Will Crypto Follow Fintech’s Path?

- Posted: 18.07.22

Fintech took the investing world by storm in 2017 and 2018.

Finance giants jumped in with both feet, holding fintech roundtables and joining initiatives in developing countries.

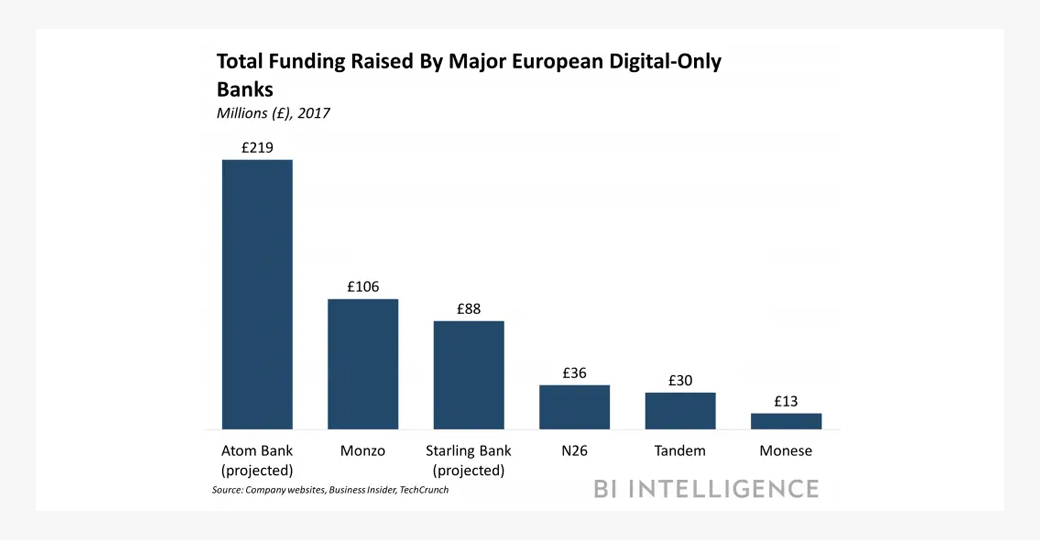

Even traditionally innovation-reluctant sectors like banking got in on the game, as upstart companies like Revolut and Monzo drew huge investment.

But if you check the headlines today, you’ll notice a less rosy outlook. There’s still plenty of money flowing into the sector, but also increasing scrutiny.

You’re more likely to see articles highlighting layoffs amid a broader fintech slump.

With fintech losing some of its luster, it’s fair to ask what this could mean for crypto.

After all, crypto’s the current big thing, drawing $30 billion in global investment in 2021.

Will crypto lose some of that luster? Or is this an “apples and oranges” situation, and both sectors will take their own path?

Let’s explore these questions in a bit more detail.

Fintech and crypto: two sides of the same coin?

Without getting bogged down in detail, it’s worth noting that fintech and crypto are closely related.

Both rely on technological development to offer innovative solutions to financial problems.

In fact, some analysts consider crypto to be a subsector of fintech. That includes leading analysts like KPMG, who issued the report we linked to earlier.

If you take that view, then any trend that influences fintech will obviously impact crypto as well – it’s all part of the natural rise-and-fall of the broader fintech industry.

But there’s a problem with that analysis, with more than one expert taking the opposing view. Actually, there’s more than one problem; we’ve highlighted a couple of the most important:

1. The blockchain is a whole new animal…

App-based banking, like Revolut, applies new tech to an old problem. But the blockchain is something fundamentally different – a whole new technology that will transform any number of problems. Ownership? NFTs provide permanent, trackable, provable ownership of unique digital assets. Payments? Decentralised, peer-to-peer transactions directly via the blockchain.

Crypto does behave like fintech, it’s true. But just scratch the surface, and it becomes apparent that crypto is something entirely new.

2. …with different underlying strengths and weaknesses…

The blockchain itself is remarkably secure, providing users with a level of security that the broader financial sector has traditionally struggled with. There are problems, of course – scams persist for both crypto and fintech. But there’s an underlying security to the crypto sector that’s missing for much of fintech.

On the other hand, fintech trades in largely familiar technologies. Everyone is familiar with the concept of banking; fintech startups like Monzo just have to apply that concept in a new way. Crypto requires education, teaching potential customers the basics of the technology prior to any sort of engagement.

3. …and the potential to transform industries entirely.

Fintech seems transformative. No more going to the bank – settle payments from your phone! Harness the power of data to make more informed decisions!

But in most cases, these applications are just improvements on what was previously there. Banking in person led to online banking, which gave way to app-based banking and then to banks based around mobile banking entirely.

Crypto offers something truly radical. To stick with the banking example, crypto offers the potential to get rid of institutional banking altogether. Decentralise the entire process; use peer-to-peer networks for payments (and track them on the blockchain itself) and use DeFi services for loans and investments.

Fintech builds on existing systems; crypto proposes new ones.

A slump is not the end

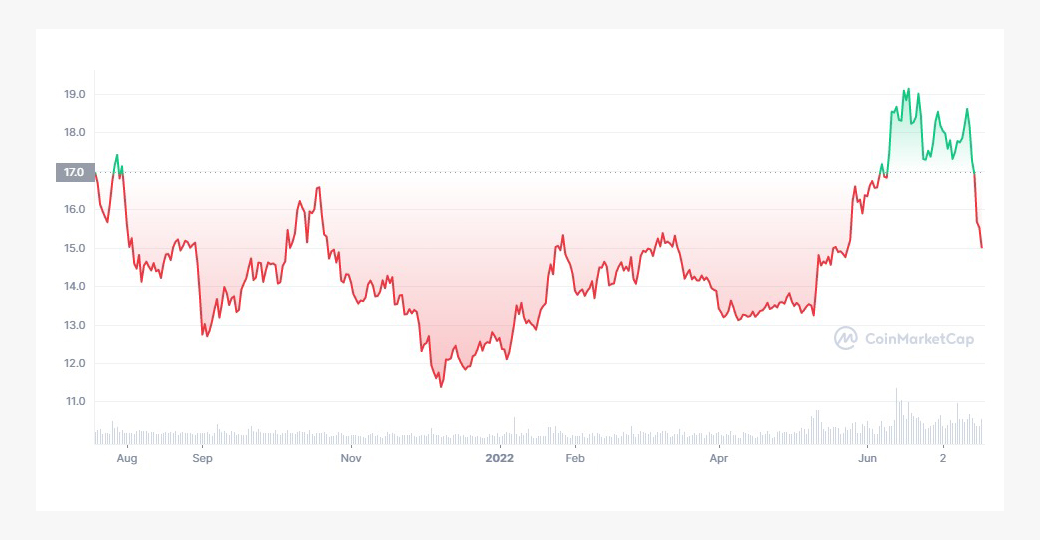

Crypto investors with any experience know this one instinctively. As new and emerging market sectors, both fintech and crypto are subject to dramatic ups and downs – crypto especially.

If fintech and crypto are part-and-parcel of the same thing, then those trends are likely tied together for the long term. It’s true that any apparent slump for fintech in 2022 does seem to coincide with a downtrend in the crypto market. At least, that’s what a quick look at cryptocurrency prices would seem to indicate:

Look more closely at each sector, and any slump seems likely to be short-lived.

On the fintech side, European VC saw nearly 300 deals completed worth 7.9 billion euros through the end of March.

Globally, crypto saw nearly $10 billion pour into the sector over the same time period. That’s more than in 2021, and is somewhat surprising given the struggles of cryptocurrencies.

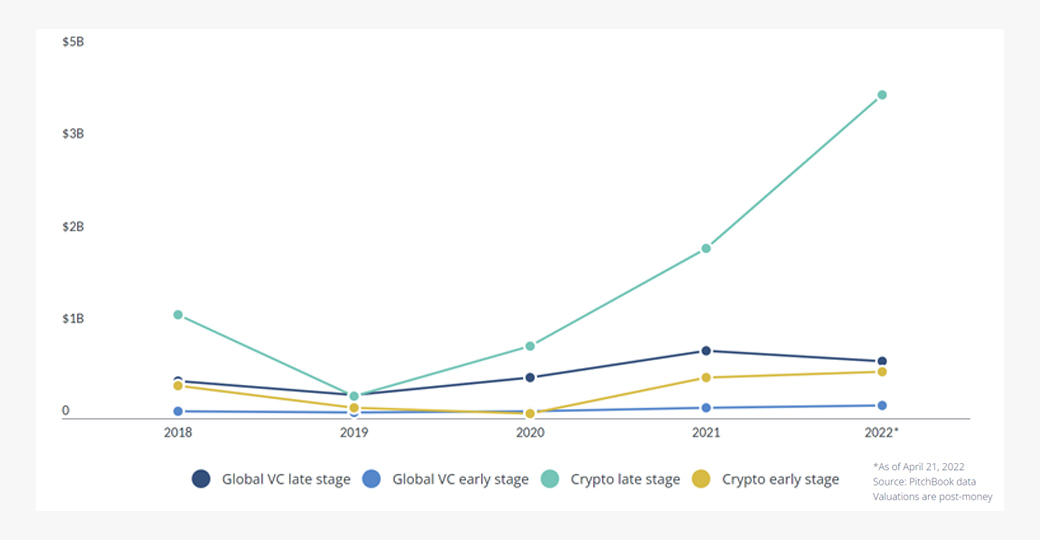

In fact, if you’re looking for signs that crypto and fintech don’t always move hand-in-hand, there’s great evidence when it comes to late-stage VC investment.

Crypto’s strength comes when late-stage VC deals are down a bit overall from 2021.

Takeaways

Maybe it’s not a question of crypto following in fintech’s footsteps.

Instead, think of crypto as a branch of the fintech tree. Crypto has the chance to build new systems entirely, with key principles – like decentralisation – that run contrary to much of the current financial system, including fintech.

At a time when that system is under increasing criticism, that’s perhaps the biggest difference between the two – and crypto’s biggest strength.

Crypto appears to be following in fintech’s path.

But in reality, it’s blazing new trails.