Terra, LUNA & UST: The Bet & Meltdown Explained

- Posted: 30.05.22

Terra came, Terra fell, and now we’re all moving on.

It’s hard to underestimate the significance of what happened a few weeks ago.

UST had a market cap of $17 billion, add that to LUNA and it equated to over $40 billion. That’s large-cap stock territory, assets with enough behind them to be safer bets than smaller ones.

And just to put this into perspective:

This wasn’t the latest airdrop of some lesser-ranked memecoin; this was an experimental but highly successful stablecoin that formed the basis of a number of incredibly popular projects. Just look at Anchor Protocol – talk of the town prior to the crash.

Now that the house of cards has come crashing down, more and more analysts are coming out with their hot takes on how they “saw it coming.”

But a few people actually did.

Let’s see what they said, when they said it – and what we can learn from it.

Twitter was the breeding ground of doubt

I want to be clear:

There were real concerns about the Terra/Luna ecosystem before it broke.

As with most things concerning crypto, Twitter was part of the story.

The best examples of doubt are from two well-known users who participated in a high-profile bet intended to demonstrate how weak Terra/Luna was.

So, what was “The Bet”?

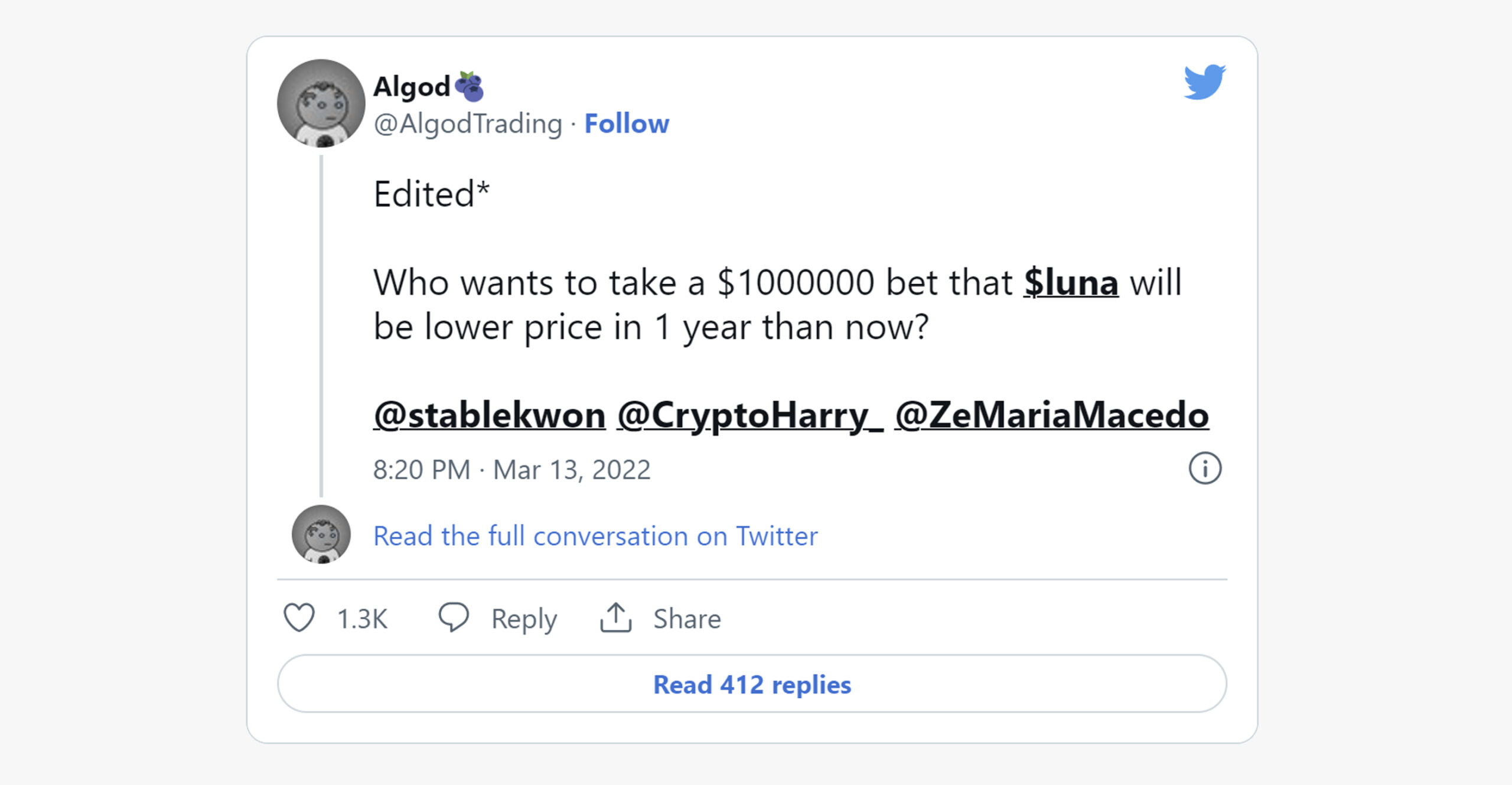

@AlgodTrading suggested a bet of $1,000,000 for $LUNA critics to put their money where their mouth was.

There were a few takers right away – and then Player 2 entered the game.

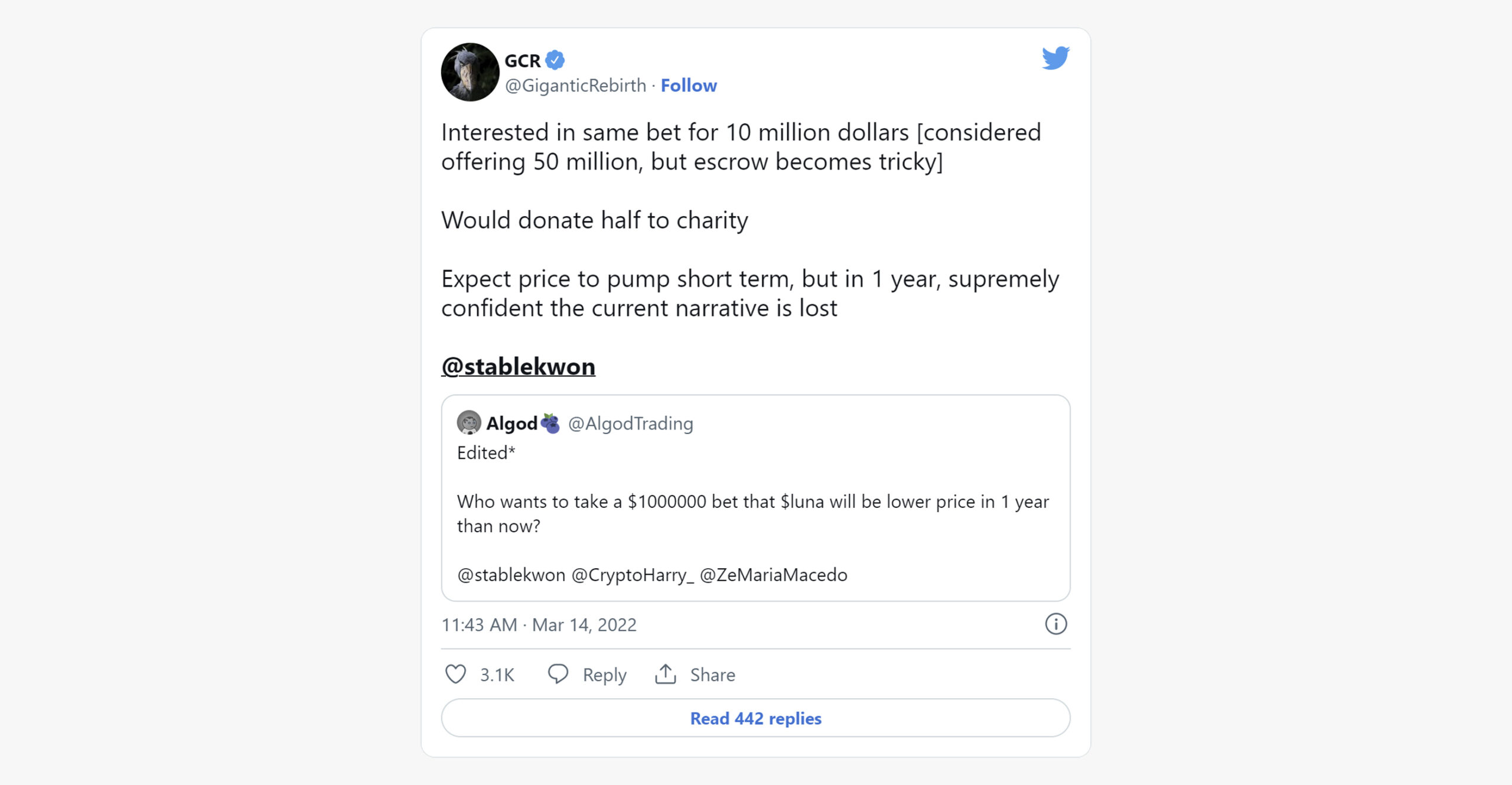

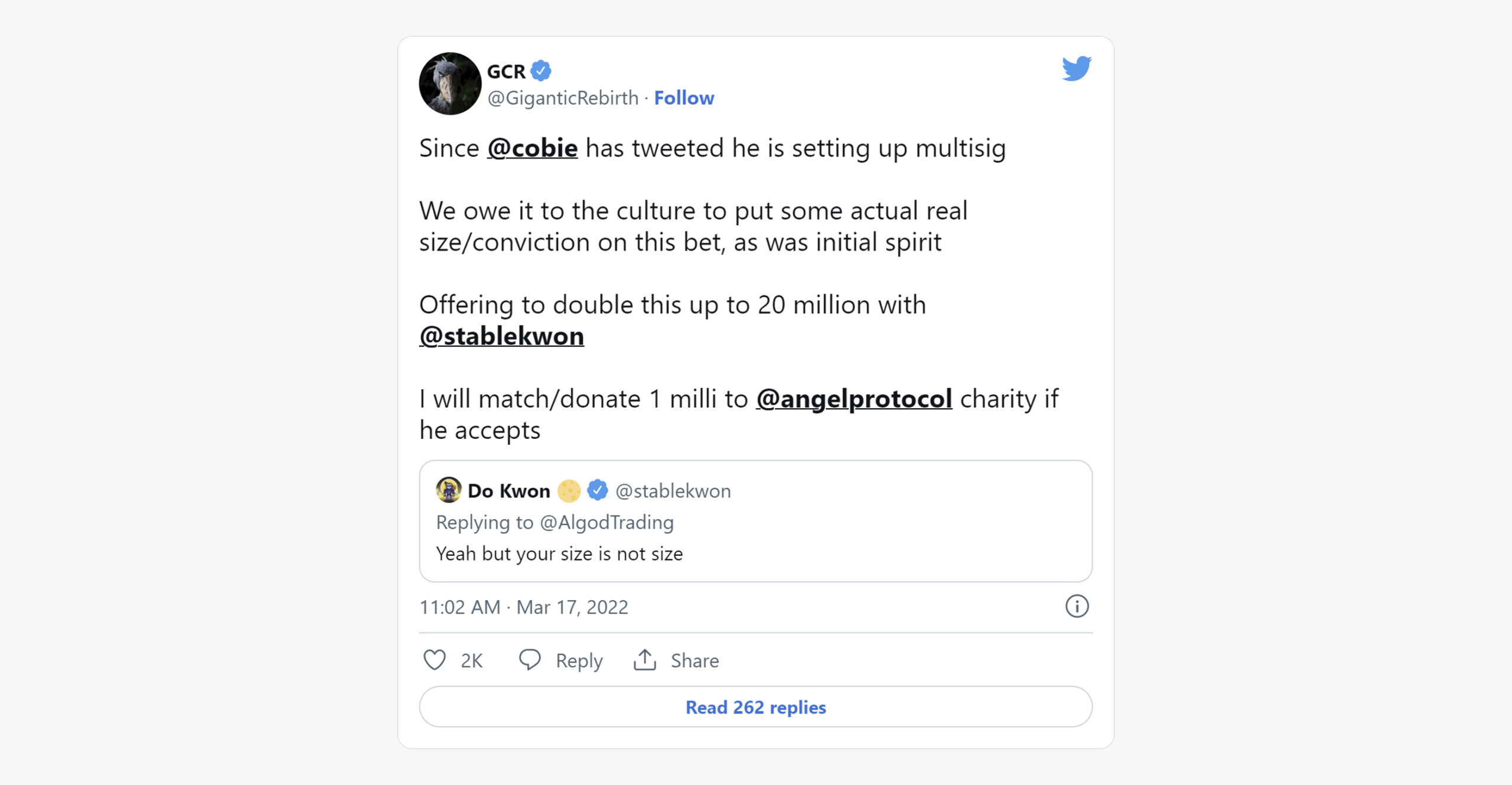

GCR – @GiganticRebirth – upped the stakes.

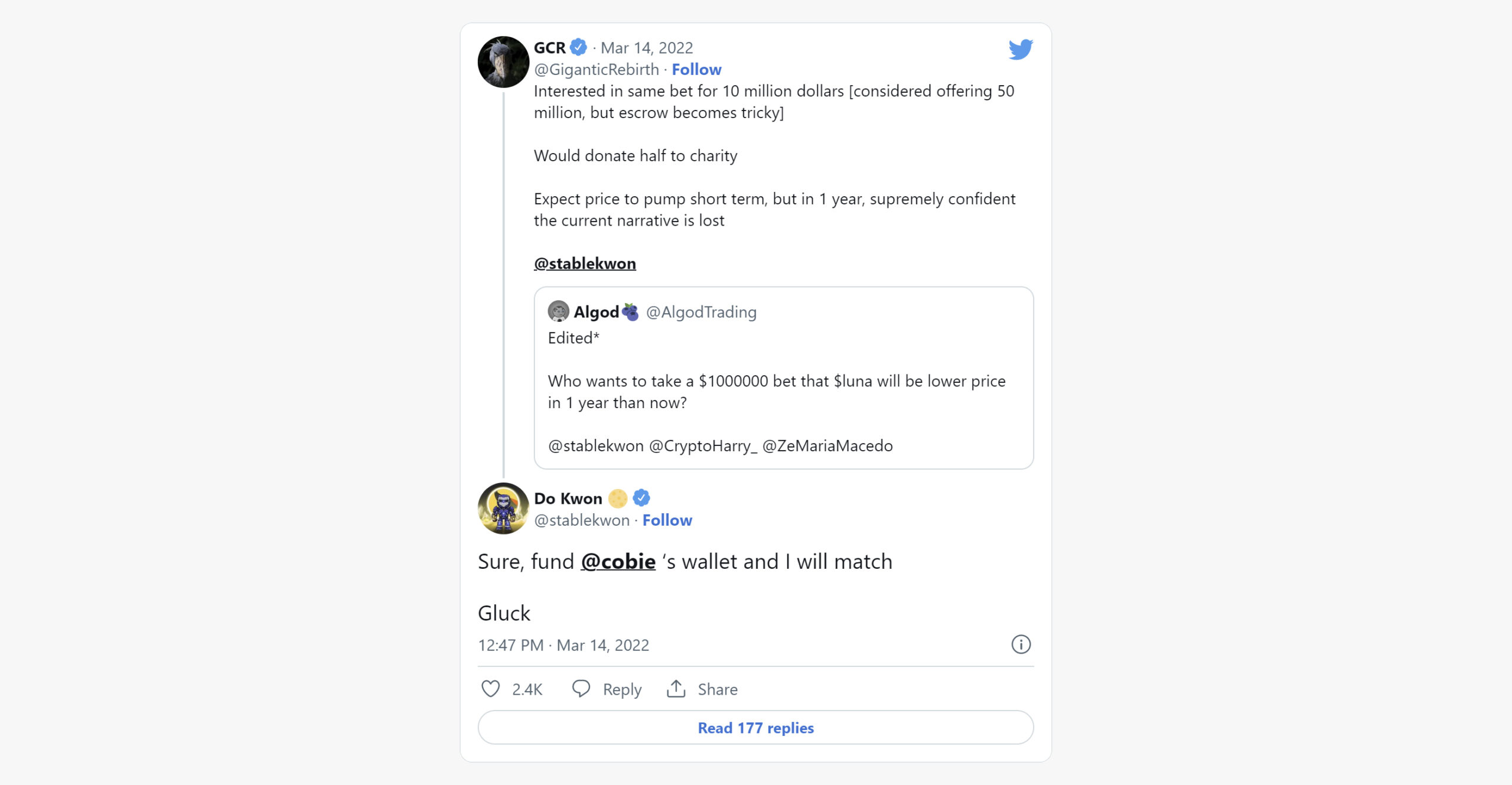

Those were fighting words, and Do Kwon took the bait.

The stage was set. We had not only money, but pride on the line too.

There was the usual haggling over details, in particular over the use of market cap (remember, Luna is deflationary, burning tokens daily per its tokenomics).

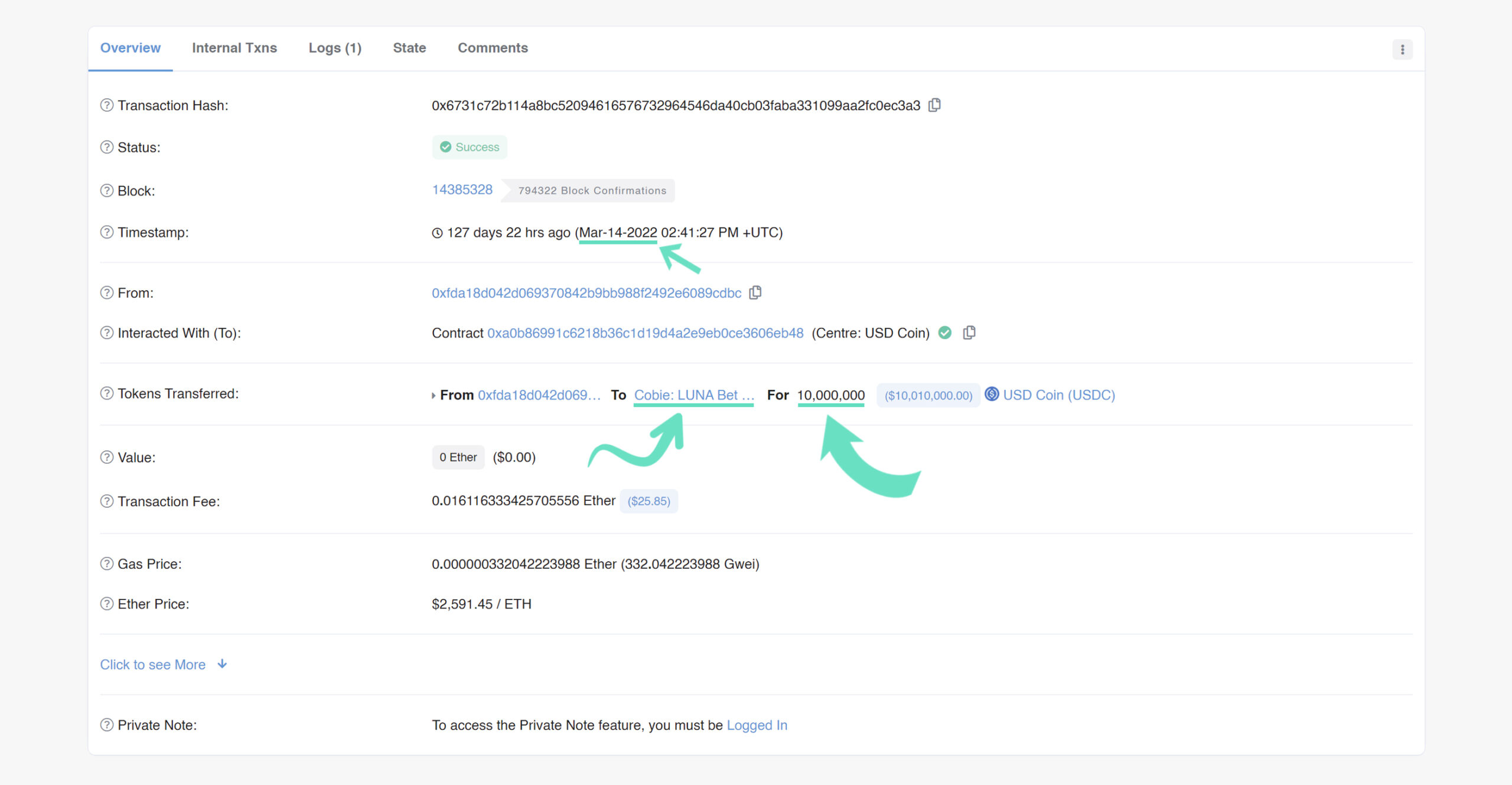

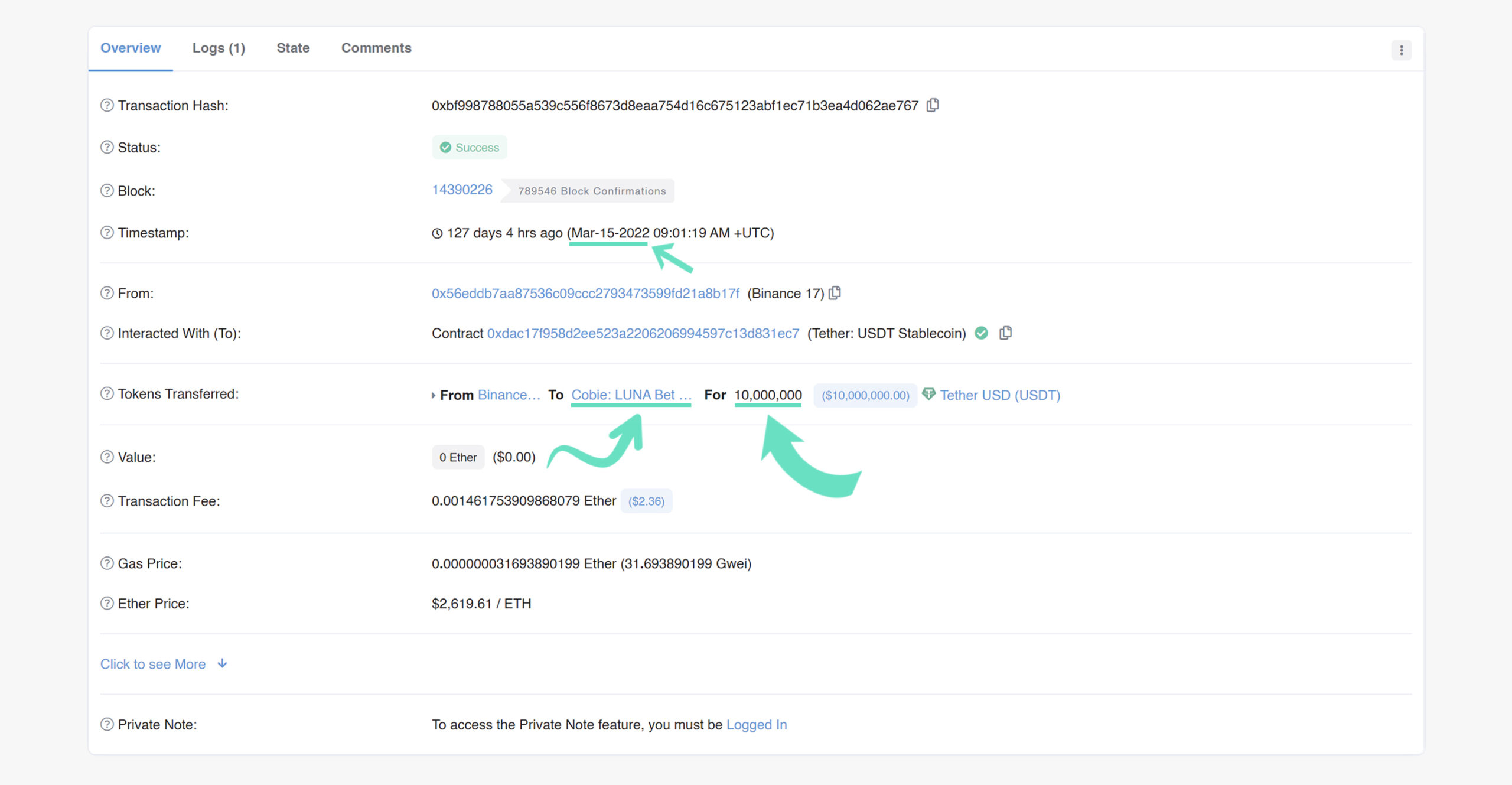

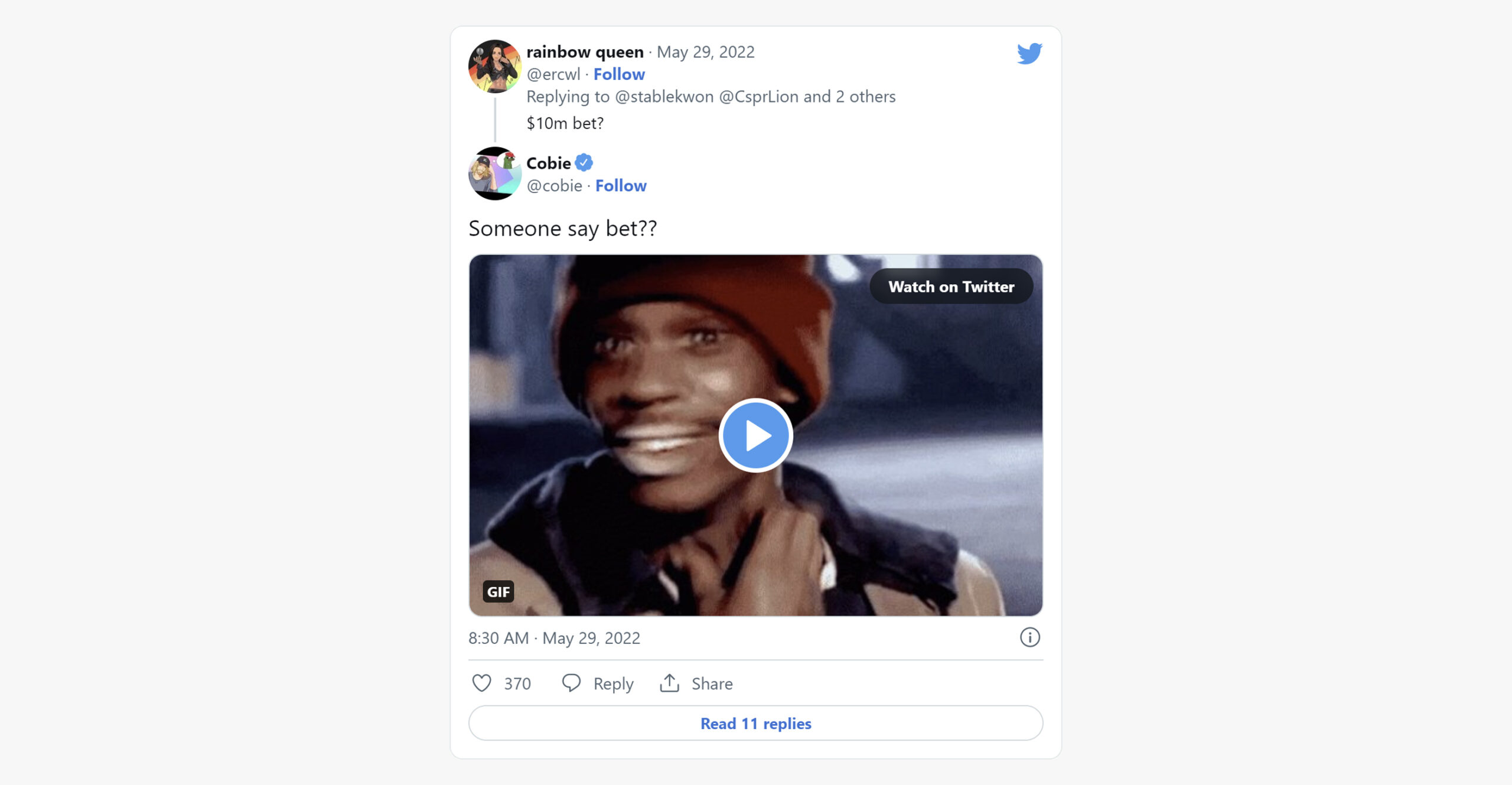

The well-known @cobie would hold the bet in escrow. GCR sent his bet – $10 million, as per the agreement – over the next day in USDC.

A day later, Do Kwon made his deposit in USDT.

Both bets were in, and the one-year clock began.

But that wasn’t enough for GCR. As news of “the bet” spread, GCR tried to get Do Kwon to double the initial $10 million.

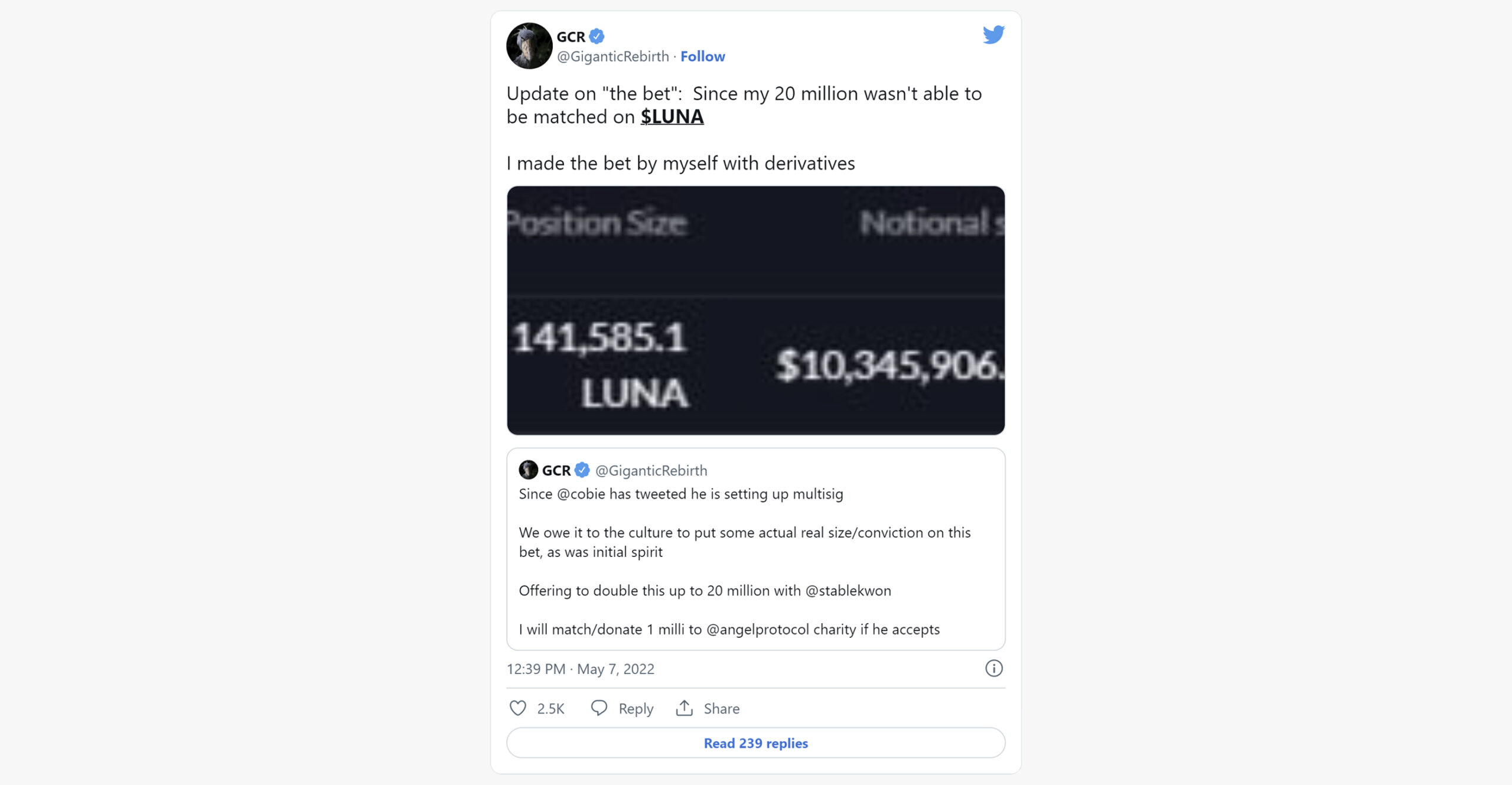

That was March 17th 2022; with Do Kwon refusing to up the ante, GCR did the only logical thing – he increased it by himself.

GCR announced his derivatives bet on $LUNA on May 7 2022. Less than 48 hours later, $UST lost the peg – and the Terra/Luna downfall began.

The Collapse

The actual collapse of Terra/Luna took place over 2-3 days between May 9-May 11, 2022. Most of you are probably familiar with the timeline, so here’s a quick recap:

May 8 – Responding to dips in the TerraUSD stablecoin, Luna Foundation Guard (LFG) began spending some of its resources to defend the peg. That meant purchasing UST with Bitcoin as well as a combination of other crypto currencies and fiat.

May 9 – Despite LFG’s increasingly-aggressive attempts to stabilize UST, the stablecoin loses the peg; you can see the turning point in the chart below:

May 10 – LFG empties its reserves, spends 33,206 BTC to purchase over 1.1 billion UST in an all-out attempt to remedy the situation. That attempt fails; between May 10-12, the UST price vacillated wildly, going as low as $0.30 and as high as $0.82 – but still well off the peg.

May 12 – LFG shifts fully into damage control mode, swapping 883,525,674 $UST to 221,021,746 $LUNA to prevent a governance attack on the ecosystem.

May 13 – By the 13th, UST had settled firmly in the teens, trading at around $0.17. Luna’s decline was even more devastating. It was trading at a few thousandths of a cent by May 13. Exactly a month earlier, Luna traded at over $86.

How did the originators of the bet make out?

GCR hadn’t exactly been idle; while holding a short position on LUNA as part of the bet, on May 12 he acquired the necessary LUNA shares to cover his position. If Luna collapsed further, he’d make millions on his short position. If the token somehow rebounded, he’d recover any losses.

How much did hedging the bet cost GCR?

A whopping $700.

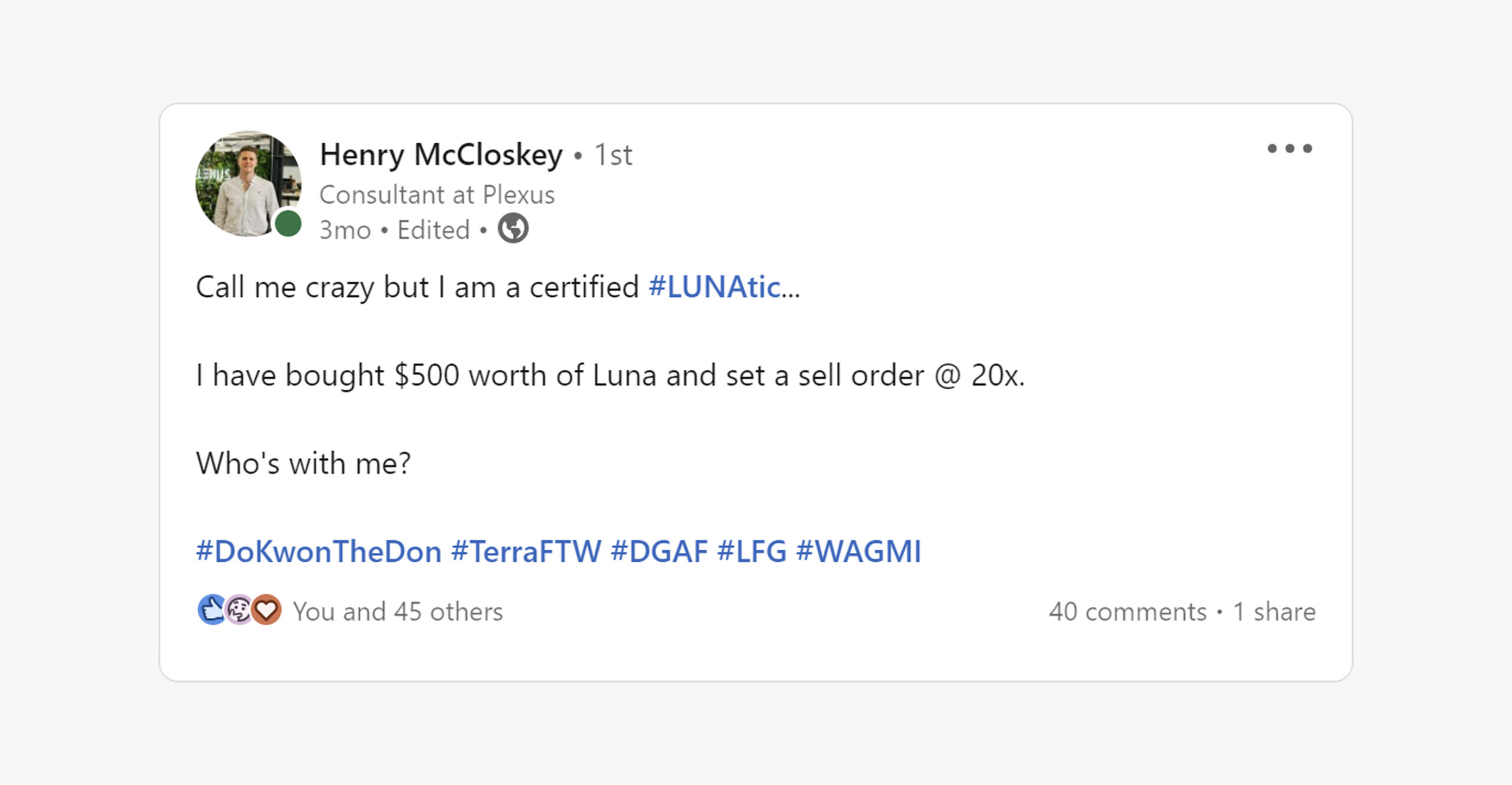

Some people tried to capitalise on this quick downturn too:

The Aftermath

So where does this leave everyone?

GCR – GCR saw weaknesses with the Terra/Luna ecosystem, put his money where his mouth was, and was positioned perfectly to profit no matter what happened. Depending on his exact LUNA holdings, GCR was even eligible to receive airdropped new LUNA tokens, giving him a further benefit even if Do Kwon is able to bring the ecosystem back.

Do Kwon – Speaking of Do Kwon – the collapse of a stablecoin with an $18 billion market cap doesn’t go unnoticed. South Korea, in particular, has a number of questions for the man behind crypto’s biggest collapse. With investigations pending and special enforcement units resurfacing, Do Kwon’s future seems destined to be filled with lawyers.

Of course, there’s also the matter of restarting Terra. This time, Do Kwon dropped the algorithmic stablecoin altogether – LUNA is now the sole token, forked off from what is now Luna Classic.

The LUNAtics – Fans of UST and Luna remained vocal to the bitter end; the proposal to fork the chain into Luna 2.0 passed with 65% of validators approving the measure. There’s also the strange insistence on referring to the whole collapse as “the attack”, something that persists even in official documentation for the new chain.

Cobie –

Takeaways

We can’t talk about the collapse and rebirth of Terra without mentioning Anchor Protocol.

The relationship between the two boiled down to this: Anchor’s astoundingly high returns – 20%!!! – drew more and more investors, with UST pouring into the protocol. That led to a serious reserve deficit problem for Terra.

A bull market covers a multitude of sins, so the problem was hidden for a while. But once the collapse began, there was no way to defend the peg other than the algo. When that failed, there was no second line of defense.

This article from Delphi breaks things down clearly. It turns out that there was a second line; that was LFG, and their admirable efforts to build a currency reserve that could be deployed when the algo weakened. Review the timeline, and you’ll see that LFG managed to stave off collapse for roughly 2-3 days. That’s impressive!

Sadly, the LFG reserve was too little, too late. Had the collapse happened later in the year, with a stronger BTC, LFG might have been able to withstand the flood of outgoing UST. As it happened, LFG put up a good fight that only delayed the inevitable.

Where do things go from here?

It’s possible that the new Terra fork will be successful. With the migration of dApps over to the new chain, and dropping the UST dead weight, perhaps Luna will rebound.

The death of UST itself is noteworthy. It led to a host of “stablecoins are dead!” headlines, but it’s worth noting that algo stablecoins are basically an experimental approach to technology that is barely a decade old. Other stablecoins, like USDC, rely on a more traditional approach to collateralization.

The collapse might have been the biggest blow to the crypto economy since the infamous Mt. Gox incident. But in the long run, this is likely to fall into the same category – devastating on an individual level, but part of a broader learning curve for the market itself.