Crypto and TradFi: An Evolving Relationship

- Posted: 28.09.22

If you spend any amount of time on Twitter, you’ll come away CONVINCED that crypto and traditional finance (or TradFi) are sworn enemies.

There are passionate people in both camps, and with most things on the internet, you feel like you have to pick a side.

BUT, they actually have more in common than you’d think.

For one, both are built on the idea of trust. In order for crypto to work, users must trust that the system will remain secure and that their transactions will be processed properly. Similarly, traditional financial institutions relies on trust between parties to function properly.

Another similarity is that both cryptocurrency and traditional financial institutions rely on network effects. The more people who use crypto or traditional finance, the more valuable it becomes. This is because crypto and traditional finance are both designed to make it easier to trade value between parties. The more people who use either system, the more useful it becomes.

Finally, both cryptocurrency, TradFi and DeFi are subject to regulation. In the case of crypto and the average crypto user, governments have been struggling for years trying to figure out how to regulate the technology. In some cases, this has led to bans on cryptocurrency trading (as in China). In other cases, it has resulted in heavy taxation (as in South Korea). TradFi, on the other hand, is heavily regulated by governments around the world. This regulation can take many different forms, but it typically includes things like licensing requirements and reporting requirements.

Despite these similarities, cryptocurrency (and digital assets in general) and TradFi remain very different beasts.

Crypto is a decentralized system that relies on digital assets to function. TradFi, on the other hand, is a centralized system that relies on fiat currencies.

This difference is key, as it means that crypto is not subject to the same restrictions as TradFi. For example, crypto can be used to trade value between parties without the need for a third party (such as a bank). This makes crypto much more versatile than TradFi.

The relationship between crypto and TradFi is still a relatively new one, and it remains to be seen how it will develop.

The Crypto Winter killed several crypto myths. Chief among them might have been the idea that TradFi and DeFi (or crypto in general) were mortal enemies. Are they destined, instead, to be best friends?

We wanted to take a closer look at what’s happening in the slow dance between crypto and TradFi.

Here’s what we found.

Decentralization might be dead (or dieing)

Cryptocurrency decentralization is the process by which digital assets are distributed among a network of users rather than being centrally controlled by a single entity.

This decentralization has several benefits, including improved security and increased resiliency. However, it also comes with some challenges, such as the need for users to have a certain level of technical expertise.

It’s safe to say that decentralization is one of the key selling points of digital assets.

By their very nature, crypto assets are designed to be decentralized. This means that they are not subject to the same restrictions as traditional fiat currencies, which are typically controlled by central banks.

The old adage for cryptocurrency was that decentralization would unlock a whole new world of financial possibilities. There’d be no centralized points of control, no institutions to bottleneck payments and transfers, and anonymity would be baked-in to the entire system.

That hasn’t exactly worked out. But why?

Let’s start with anonymity.

Yes, it’s true that my name doesn’t appear on any of my crypto wallets. But as the crypto economy and user base grows, and as big players continue to dominate, it’s increasingly easy to identify certain wallets.

That’s a two-edged sword.

On the one hand, it’s made tracking scammers and con artists a bit easier. The growing crypto security sector now features companies that focus on preventing fraud, as well as ones that track down fraudsters.

But it also means that anonymity on most blockchains isn’t quite as pervasive as it used to be.

It’s a big enough problem that privacy coins are a thing – a growing sector of specialist cryptocurrencies that do what bitcoin was supposed to do automatically.

That’s not a knock against bitcoin; it just highlights that as the industry matures, the general sense of anonymity and privacy has given way to the need for integration, scalability and growth.

TradFi has always LOVED the big players, and that seems to be creeping into crypto too:

There’s a rise of traditional finance style “blue chips”

There’s no two ways around it: Big players dominate TradFi.

You’ve got blue-chip stocks, industry giants, near-monopolies – TradFi loves giants.

And increasingly, so does crypto.

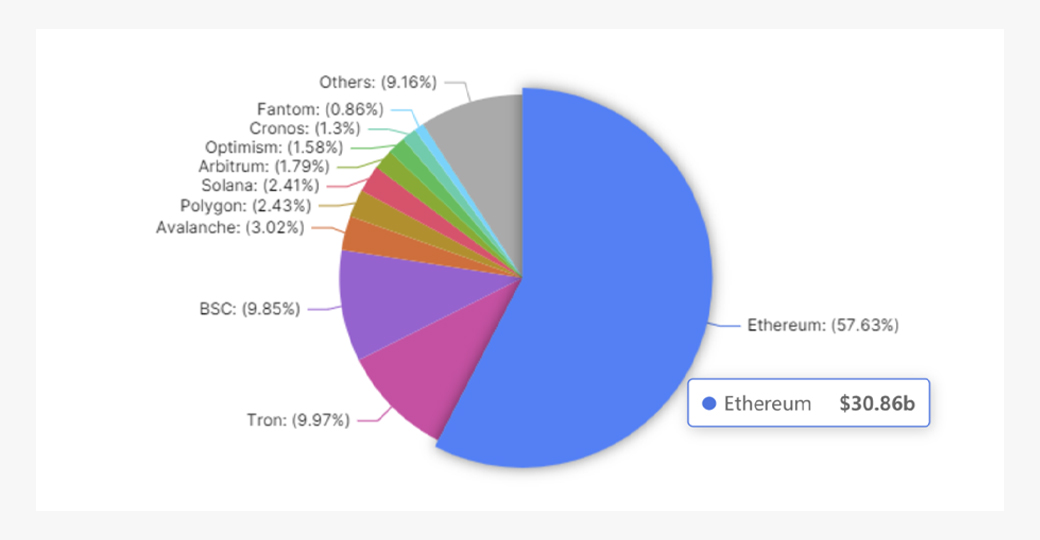

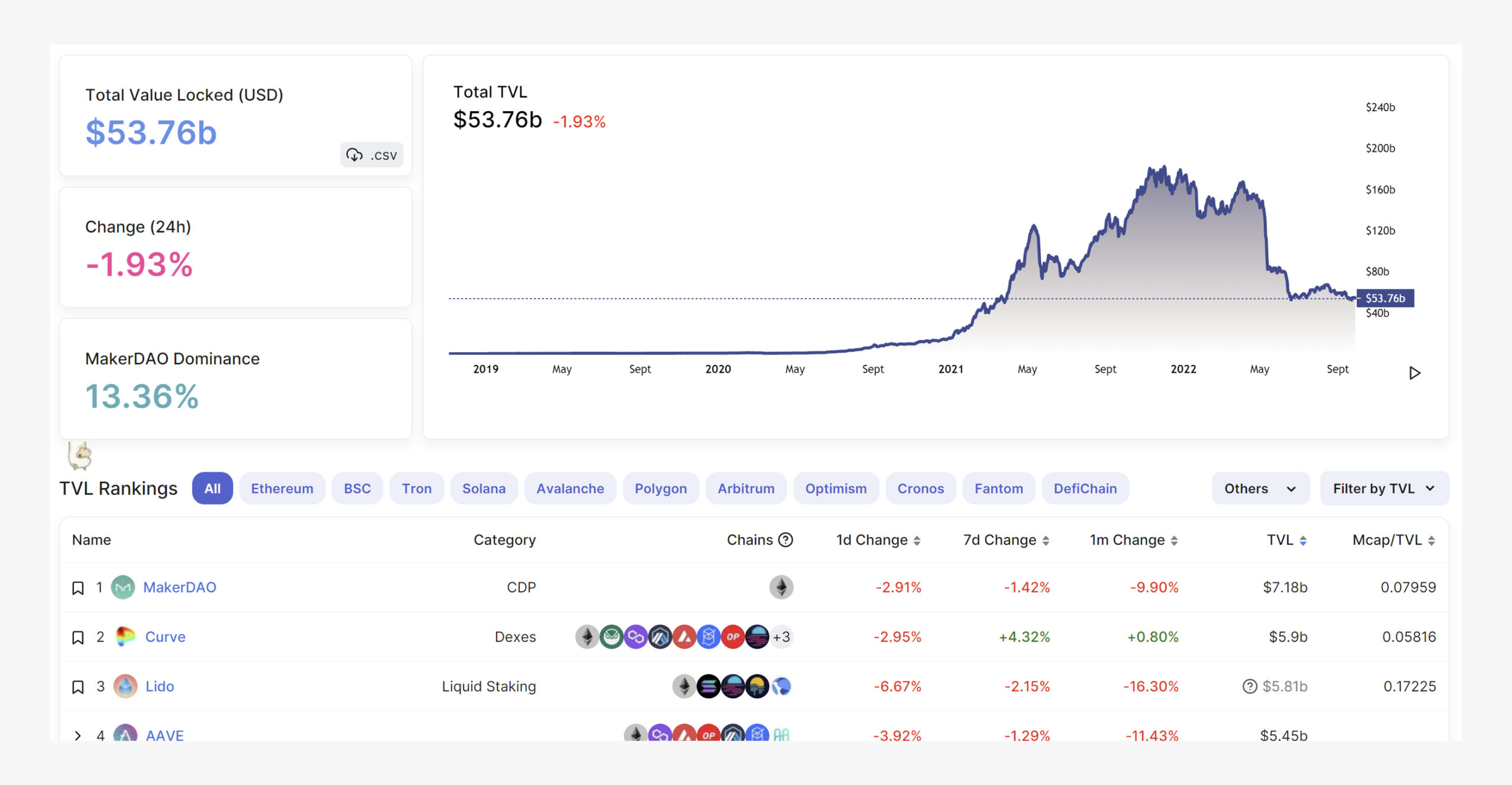

For all the talk of Ethereum-killers, Solana, Avalanche, and others still hold less than half of DeFi TVL between them. Ethereum has nearly 60% of total value locked-up on-chain.

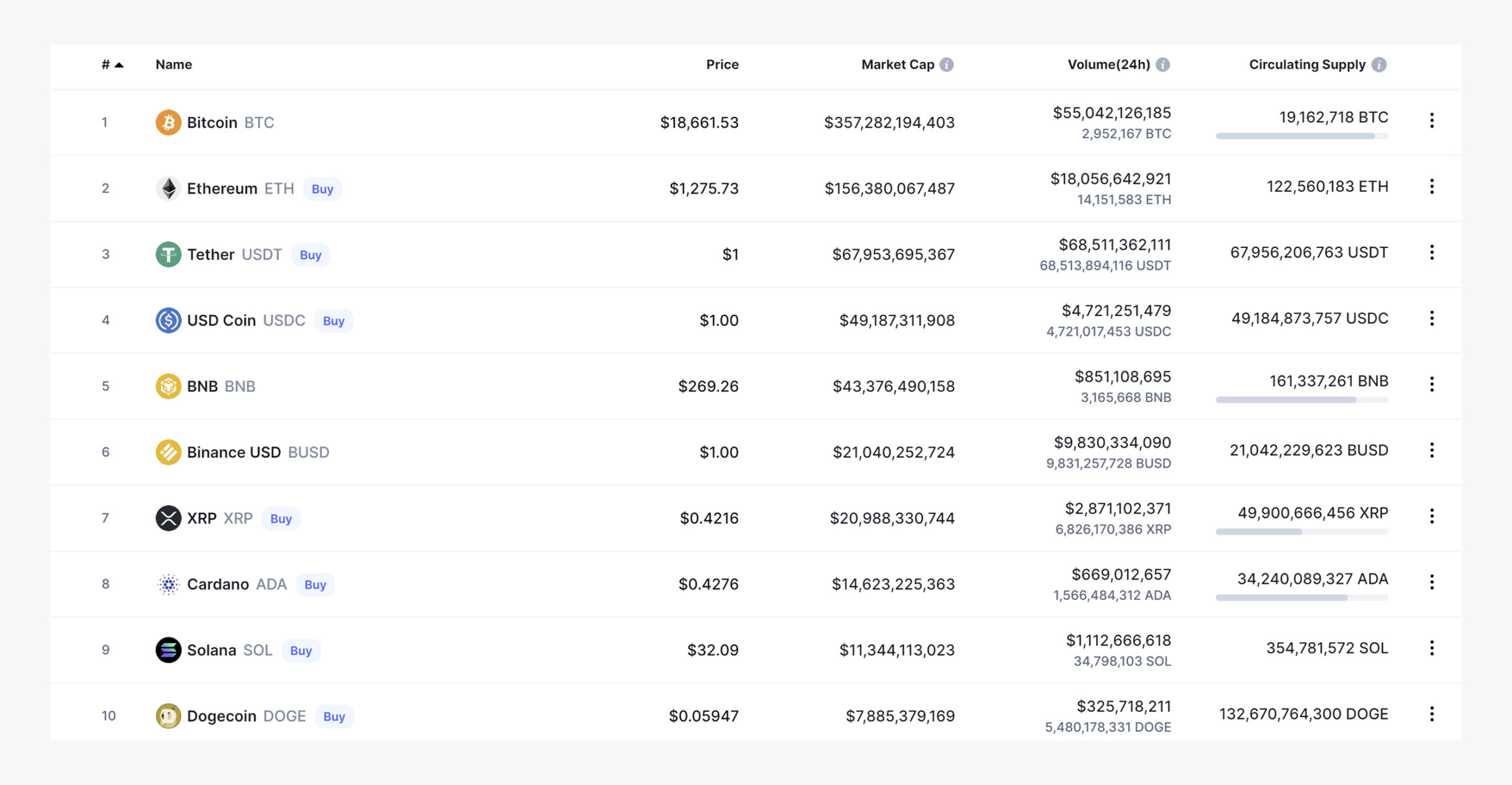

And of course, Bitcoin itself is still the elephant in the room, with Ethereum coming second. The numbers drop off fast after the top two, with USDT, USDC, and BNB.

The point is, big players still dominate crypto in the same way that they dominate TradFi.

And that’s not necessarily a bad thing.

The rise of blue-chip cryptos brings with it increased legitimacy, stability, and confidence. Investors are more likely to put their money into an asset that has a large market cap and is less likely to experience wild swings in price.

In other words, parts of the crypto space is starting to look a lot like TradFi.

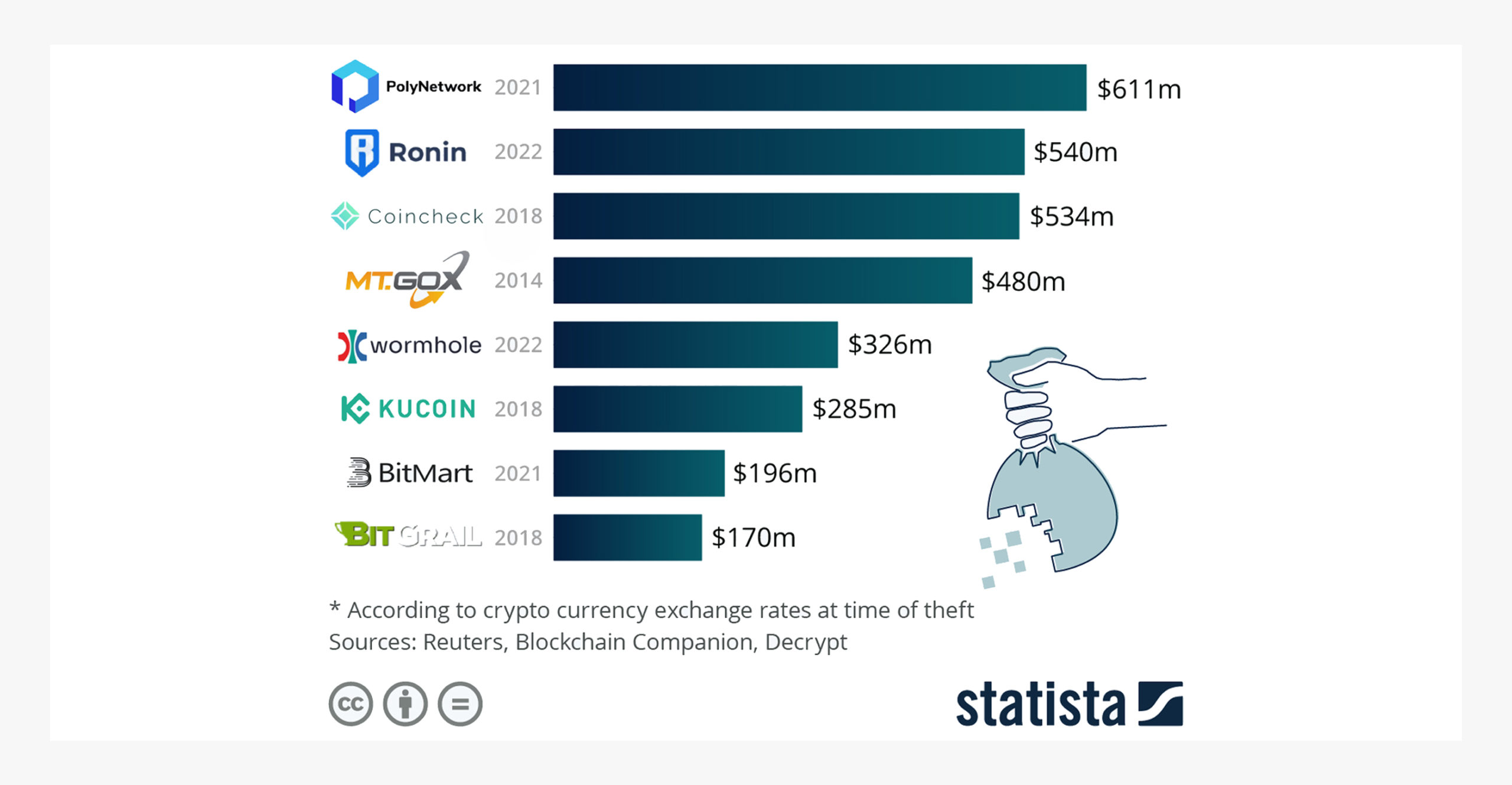

Of course, this centralization comes with its own set of challenges. The most obvious one is security.

The more centralized an asset is, the easier it is for bad actors to target. We’ve seen this time and time again in crypto, with high-profile hacks of exchanges, wallets, and even smart contracts.

The other challenge is censorship. When power is centralized, it becomes much easier to censor certain kinds of activity. We’ve seen this happen with crypto too, most notably with the 2017 fork of Bitcoin that led to Bitcoin Cash.

So, while crypto may be starting to look a lot like TradFi, it’s important to remember that there are still many key differences in the technology. And those differences will become more important as crypto matures.

In the meantime, it’s important to keep an eye on how crypto and TradFi are evolving. After all, they’re not really two separate industries anymore. They’re starting to look a lot more like one another.

BUT, it isn’t just cryptocurrencies and their price.

On the NFT side, BAYC and Cryptopunks are the blue-bloods, and founder Yuga Labs is the big name. And it’s getting bigger; you can read more about the Yuga Labs crypto empire here.

What’s the point? Decentralization isn’t as big a deal as it was cracked up to be, and like TradFi, crypto is dominated by big names and big companies.

TradFi tools are quietly making their way into crypto too:

TradFi Tools For Crypto Bros and their digital assets

The crypto sector is getting more sophisticated. That much is obvious, but what’s less obvious is how that sophistication pulls crypto and TradFi together.

Crypto data analytics have always been front-and-center in the crypto economy. From basic platforms like CoinMarketCap and DefiLlama…

…these TradFi tools are designed to give crypto investors the same kind of data heavy information that traditional investors have. And that’s a good thing!

Because as crypto matures, it’s going to look at what TradFi has done right and wrong over the years.

We’re seeing crypto companies getting listed on traditional exchanges and crypto assets being used as collateral for loans. And as that convergence continues, we can expect to see more and more TradFi tools making their way into the crypto world.

We’ve also seen a growing number of more advanced tools too that an everyday user can access.

Dune lets you track individual projects with community-led stats, giving users the ability to create their own dashboards and customize stats for their own portfolios.

HodlIntel focuses on NFTs. Users can follow projects or wallets, searching trading patterns to detect emerging trends.

If these tools seem extremely high-end and market-focused, well, they are. We’re seeing more treatment of the crypto market as a market, with “investors” rather than just “users.”

And it isn’t just analytical tools. You can invest in crypto index funds modeled after traditional stock market index funds. And there’s been some fascinating reporting on the human side – it turns out that Wall Street traders and crypto bros aren’t so different after all.

What’s next? Predicting TradFi’s response to crypto’s growth

It’s becoming increasingly clear that as the years go by, TradFi is becoming less and less apposed to crypto. This isn’t David and Goliath; instead, TradFi and crypto are on course to be heads and tails of the same coin.

In the grand scheme of things, crypto is still in its early stages, and it’s undergone a lot of changes in a short amount of time. It’s been hard for TradFi to keep up, and as a result, there’s been a lot of scepticism from the traditional financial world.

But as crypto has matured, we’ve seen a gradual shift in attitude from TradFi. Where once crypto was seen as a threat, it’s now being viewed as an interest and opportunity.

There are a few key reasons for this change of heart:

1. The rise of institutional investors

2. The increasing regulation of crypto

3. The growing use of crypto as collateral

As crypto continues to grow and evolve, we expect to see TradFi become more and more involved.

You can see how this narrative has shifted in these seemingly-negative comments from big-wig Wall Street figures. There’s criticism – “most of crypto is still junk” – but the broader sentiment is interest, not opposition.

Tradfi wants crypto to succeed. It sees the relationship between the two markets as mutually reinforcing, not opposing. The growing number of experienced TradFi hands who have moved to crypto speaks to this point. One side feeds the other.

We’ve found that if the founders of web3 companies have previously worked in more traditional companies, they’re more understanding of the transferable skills that come with TradFi. Whereas a small start-up of 5 crypto natives are more likely to stay away from hiring people with traditional backgrounds.

Remember, crypto is typically seen as “anti big banks”, so hiring somebody with TradFi experience might be seen as a step in the wrong direction for some crypto native founders.

Web3 start-ups also have to consider the adaptability of the hires they make – when your team is only ~5 people, every person is crucial to the success. Web3 project founders might value the small team experience that comes with crypto experience vs huge teams that are associated with TradFi.

The crypto world is still young, and it has a lot to learn from TradFi.

But as crypto matures, we expect to see the two industries work more and more closely together. There’s a lot of potential for collaboration, and we’re already seeing crypto companies adopting TradFi tools and TradFi companies investing in crypto.