Why Sports Sponsorships Are CRUCIAL For Crypto

- Posted: 19.04.22

Sports sponsorships from companies looking to increase their visibility has been a lucrative investment ever since Michael Jordan stepped onto the court in his Air Jordan’s in 1985.

You cannot watch any sport without being bombarded with adverts from soft drinks to credit cards.

And it’s easy to see why it’s so popular:

If you want a guaranteed growth model, you don’t look for new money opportunities. You just find where the existing big money is already going.

Then add more to it.

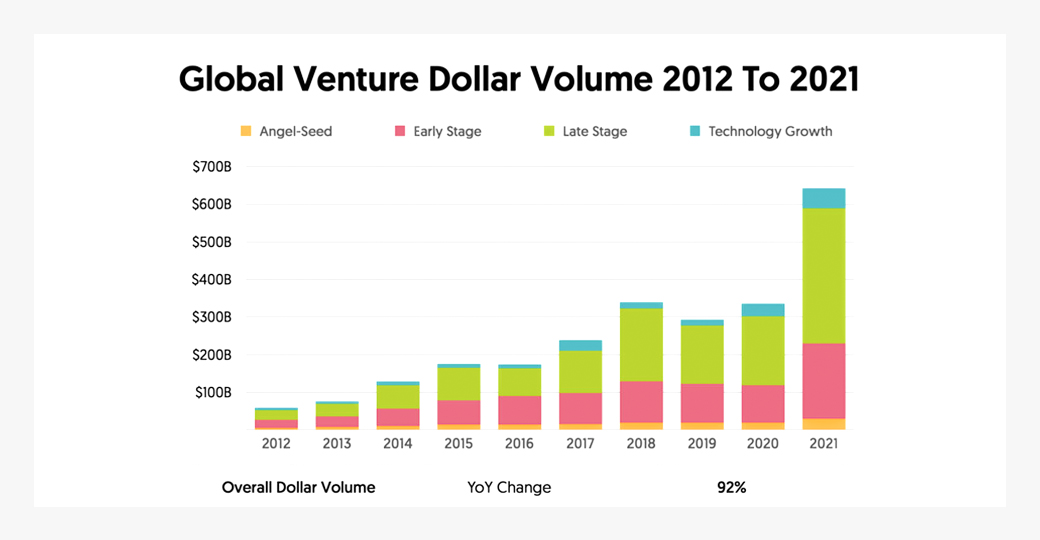

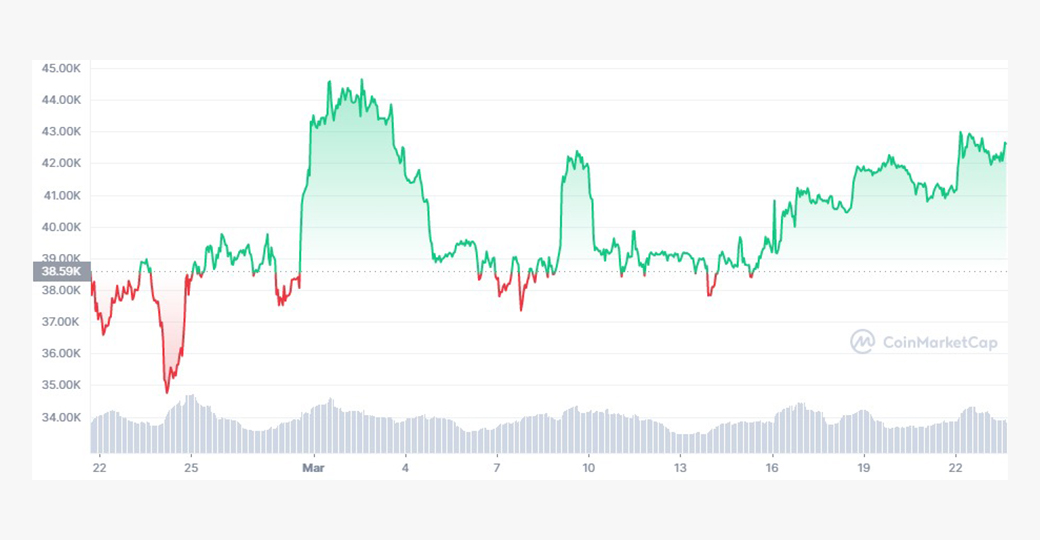

If there’s one thing that the crypto space isn’t lacking, it’s money.

This is why crypto sponsorships in sports is only going to grow in the coming years.

At the moment, there are three main areas where crypto will intersect with sports:

- Sponsorships

- NFTs

- Metaverse

Our team at Plexus has combed through some of the leading research to shed some light on one of the biggest emerging crypto trends of 2021-2022. NFTs, the metaverse, tokens – the combination of crypto and sports has it all.

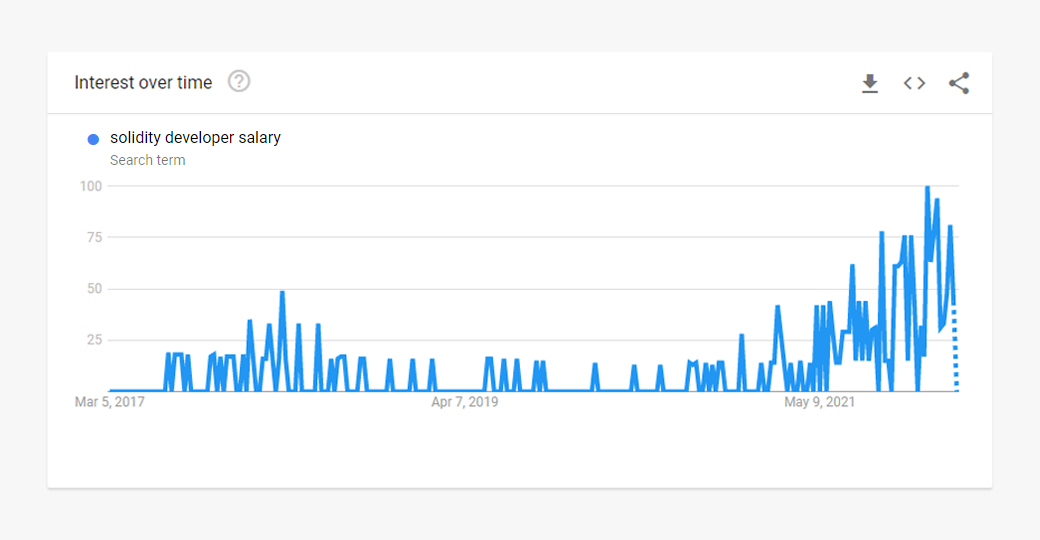

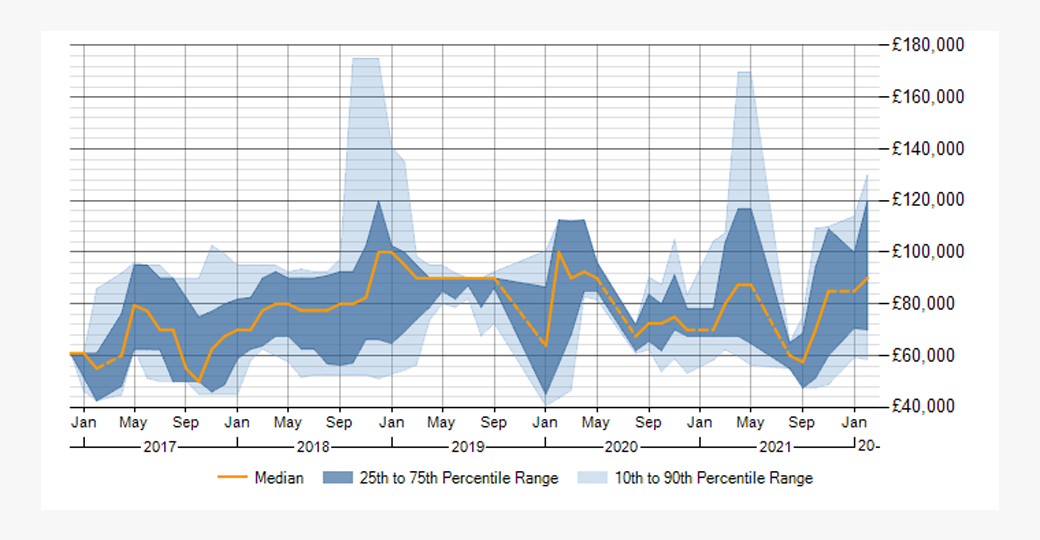

(On a side note: We recently released a State of Crypto Hiring Report which talks about salaries, in-demand skills and the growth of solidity, rust & NFTs; you can download that here.)

It’s all heading to a potentially multi-billion-dollar market.

Let’s jump in.

Crypto brands are snapping up whatever they can get their hands on

“Crypto is not just another shoe.”

For Steven Kalifowitz, CMO of Crypto.com, crypto sponsorships exist in a different league than apparel deals.

So far, he’s not wrong.

That quote came in the midst of a big run of sports sponsorships for the Singapore-based crypto exchange, including AFL and AFWL teams in Australia and NHL teams in Canada. The string of sponsorships was headlined by one of the biggest stadium sponsorship deals in sports history: renaming the Staples Center, home to the L.A. Kings, to the Crypto.com Arena.

That was a 20-year, $700 million deal, and it cemented just how big crypto sponsorships can be.

Following a boom year in 2021, and meteoric growth before that, crypto companies that are flush with cash are finding ways to spend it. And while the immediate goal is obviously to boost the profile of individual companies, the side effect is to raise awareness of the crypto world more broadly.

This may have created a little fomo for some other brands:

FTX purchased the rights to the Miami Heat stadium, now FTX Arena. That one was a bit of a bargain at only $135 million for 19 years; someone got a deal, apparently.

Beyond NBA stadiums, there’s a laundry list of sports sponsorship already underway:

- UFC and Crypto.com

- MLB and FTX

- Rugby and Luno

- Socios and European Football

- Manchester United & Tezos

- Manchester City & OKX

Individual players are getting in on the game as well – most notably the king himself, LeBron James, working with Crypto.com.

So for the average crypto investor, there’s a couple of questions worth asking:

What other ways are the crypto and sports worlds coming together?

And just how much money is at stake?

The NFT model is a collectors dream

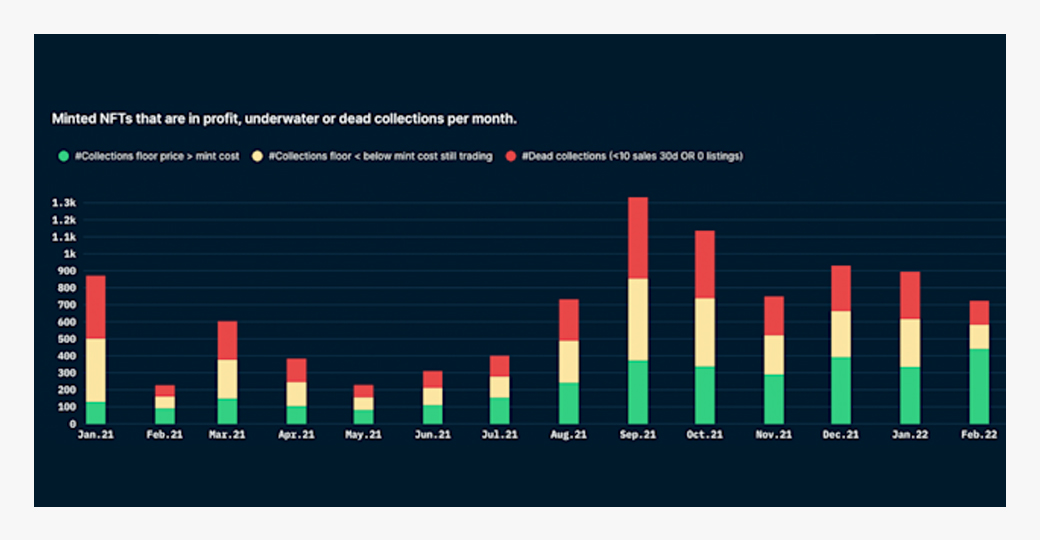

We know – the “NFTs had a big year in 2021” angle is a bit overdone. It’s still worth a quick reminder of just how quickly the NFT market sector grew:

Sports sponsorships are typically long-term deals and the idea is nothing new. Companies have been sponsoring teams and athletes for decades.

But NFTs in sports have the potential to be little short of revolutionary.

Take a recent report from Price Waterhouse Cooper (PwC), which highlighted the number of ways NFTs are already making an impact – or are poised to. Those include:

- Collectables

- Season Ticket Holders

- Virtual Access Tokens

Sports collectables are still dominated by cards – baseball cards, American football cards, NBA player cards, etc. The total sports collectible market exceeded $4 billion by itself in 2021, with expected annual growth of roughly 10% for the next decade.

What if even a quarter of the current demand for player cards was replaced with NFTs? Players could mint their own series, each slightly different in appearance and cryptographically unique.

The NFT holder has something verifiably unique with all the transaction history recorded on-chain; no worries about damaged or destroyed cards.

Season tickets would be even easier to integrate. Some real-world events, like Coachella, have already begun to experiment with limited-edition NFTs that serve as access passes and special tickets. Leagues and teams could follow suit, issuing a set number each year.

Following the Coachella model, season ticket NFTs could also function as virtual access tokens. Holders would not only gain season ticket holder status, but would also gain an invite to special events, player meet-and-greets, and a number of other perks.

Given how expensive such experiences can be in real life, the potential value of such NFTs could potentially be immense.

How immense? Hard to tell – but there’s only one of the Coachella Keys currently available on Coachella’s native marketplace. It sold for over $100k originally, and now the holder is looking for a cool $1 million.

Sports in the metaverse

All of the NFT aspects – collectable, season ticket, and access pass – come together in the metaverse.

Imagine an NFT bearing the image of an MVP candidate.

That card updates after each game with player stats, becoming a complete year-long record of their performance at the end of the year. Holders of a particular series of cards get access to player-specific press conferences or meet-and-greets, and the first issue of each player’s NFT card series (or a specified number, or maybe a team-specific NFT instead of player-specific) also functions as a season pass.

Add in the metaverse. A player card, displaying a particular image, could be used to decorate a space in the metaverse. Team cards could grant access to a team-branded lounge in the metaverse, or perhaps to a special arena. There could even be metaverse-based training and signing days, allowing fans to interact with the stars of tomorrow.

It’s already starting to happen; Snapchat recently released a filter transporting viewers to Lebron James’s childhood bedroom – in the metaverse. The filter references a Super Bowl ad which featured James, integrating today’s star speaking to his past self.

The ad blended AR tech and Solana’s Portal metaverse to produce something unique.

This isn’t just a flash in the pan

Where do we go from here?

Crypto sports sponsorships aren’t going anywhere. That Crypto.com Arena? 20-year deal. FTX Arena? 19 years.

With Steph Curry jumping in on NFTs and LeBron James carrying the crypto torch, we’re only at the beginning of the crypto/sports tie-ins.

And if collectables alone are a $4 billion market, how much will sponsorships plus collectables plus NFTs be?

Aaron Harrison

Connect with me: Here’s my LinkedIn, telegram AaronPlexus and email.

xe.com

xe.com tradingeconomics.com

tradingeconomics.com tradingeconomics.com

tradingeconomics.com coinmarketcap.com

coinmarketcap.com

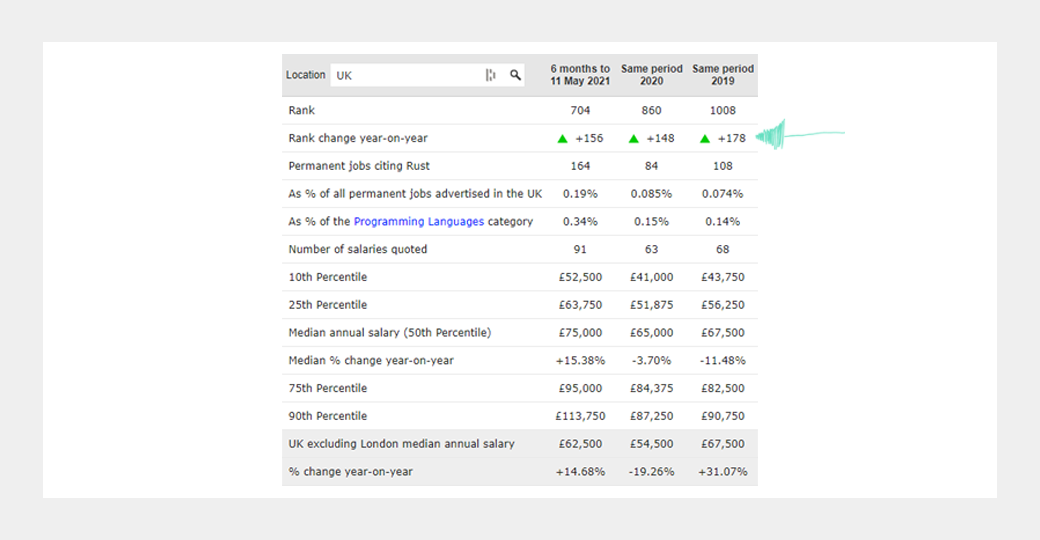

itjobswatch.co.uk

itjobswatch.co.uk Data taken from the

Data taken from the  itjobswatch.co.uk

itjobswatch.co.uk

Companies consulted for our research

Companies consulted for our research Treasury holding options

Treasury holding options Hired.com

Hired.com

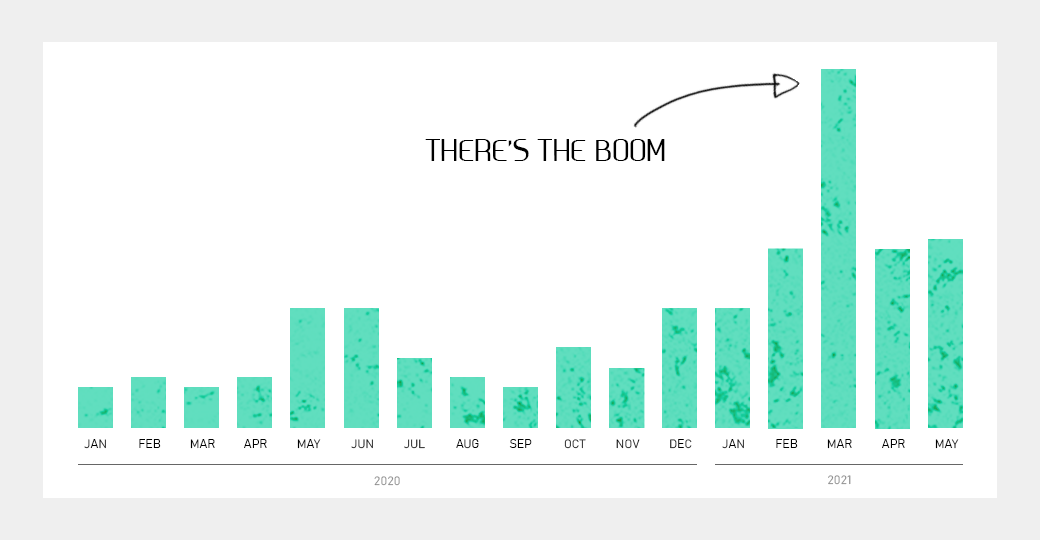

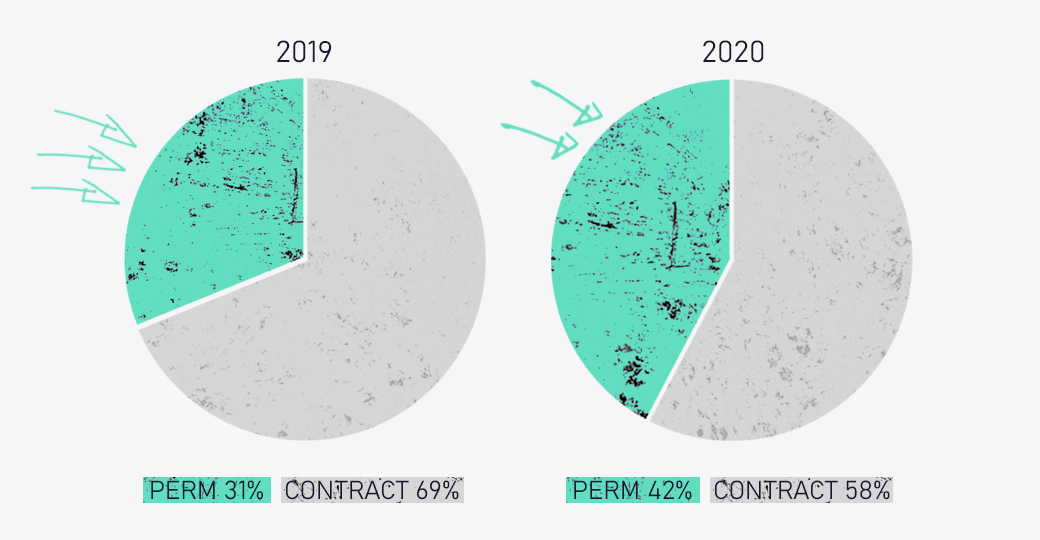

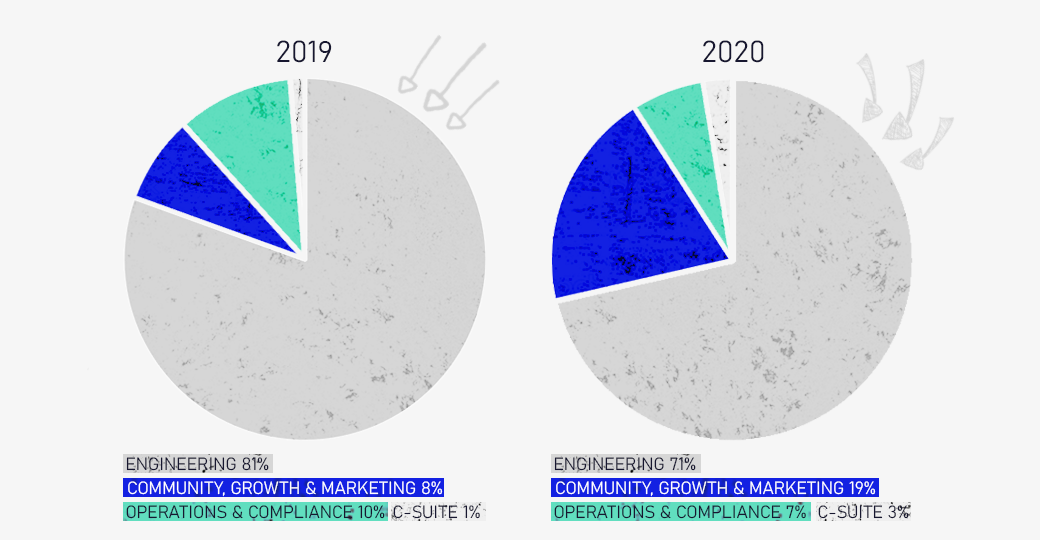

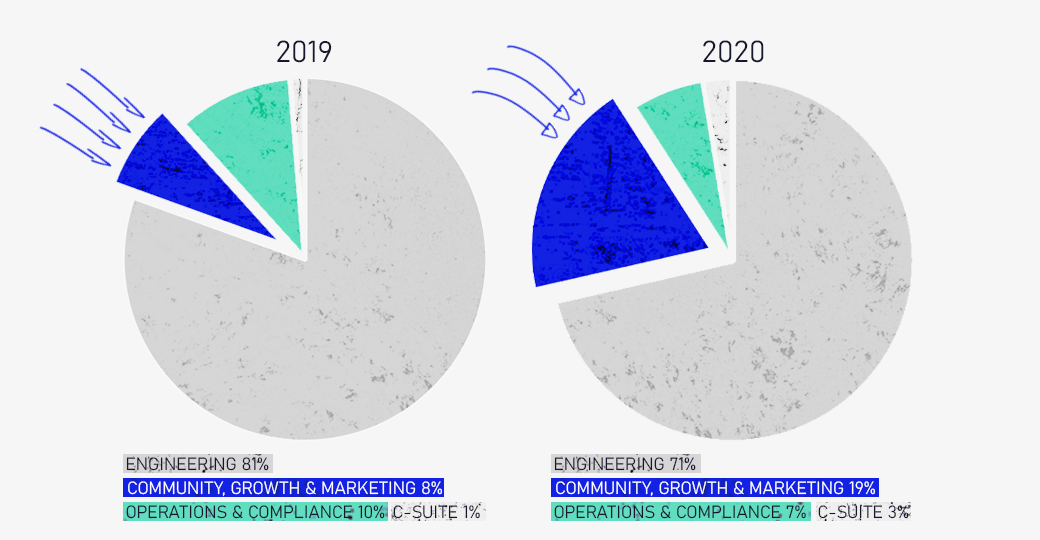

Taken from Plexus’ internal data

Taken from Plexus’ internal data Rust demand in the UK by

Rust demand in the UK by

From

From

Internal data from Plexus

Internal data from Plexus Internal data from Plexus

Internal data from Plexus Internal data from Plexus

Internal data from Plexus