Interview with Areiel Wolanow, MD of Finserv Experts

- Posted: 09.01.19

Hi, I’m Colin Platt, co-host of the Blockchain Insider podcast, and a cryptocurrency and distributed ledger researcher and specialist. Happy New Year 2019, may this be a prosperous year for all of you. Zeth, Shaun, their team at Plexus and I have had a lot of talks about what is happening beyond pure banking in the blockchain space, so we decided to change up our regular posts this week with an insightful interview with Areiel Wolanow, MD of Finserv Experts. Areiel has had an amazing experience around delivering new technologies at large financial institutions, including within insurance. He also served as an expert and advisor to governments on blockchain technologies.

CP: Hi Areiel, thanks for agreeing to speak with me. Could you share a bit about who you and Finserv Experts are?

AW: I am the managing director of Finserv Experts, a small consultancy firm that provides both delivery and advisory services for DLT solutions. I have led the delivery of working blockchain solutions for a number of global financial enterprises, such as HSBC, Bank of America, and Lloyd’s of London. On the advisory side, I have engaged with several central banks and financial regulators around the world, addressed the G20, and am currently an expert advisor for the UK Parliamentary working group on blockchain.

CP: When you speak with large companies or government and high-level groups, how do you explain that innovation that you see in blockchain technologies?

AW: Blockchain is the latest answer to what is probably the world’s very first business requirement: the need for an independently verifiable future commitment between two or more parties. This need first emerged when we evolved from hunter-gatherers and first started planting crops and living in cities and villages, and many of the world’s most important business innovations – from writing to money to accounting to enterprise software – were simply better ways of addressing this one very old requirement. What DLT offers is a way for different people or organisations to share a single version of the truth, but still physically and legally own their own data. When I present on DLT, a simplistic but very effective definition that seems to work very well in getting the main idea across is: blockchain is simply Dropbox for ledgers. You write a transaction once, and it is automatically synced to the ledgers of every party to that transaction.

CP: A lot of people equate enterprise DLT with banking. You work a lot with the insurance sector. What are some of the pain points in that market and in your mind, how are these innovations relevant to solving these problems?

AW: The insurance industry tends to be thought of as being particularly resistant to rapid change. Given that the goal of insurance is to more effectively manage risk, most people both inside and outside the industry are okay with this and see the inherent conservatism as a good thing overall. But radical innovations can and do happen in insurance. In my lifetime, for instance, retail brokers for most forms of personal insurance have gone from being ubiquitous to virtually non-existent due to the fact that aggregators have a business model that serves most people’s needs far more effectively and efficiently than retail brokers were able to. DLT offers similar transformative potential as a clearing mechanism between multiple parties, a fraud detection aide, a loss mitigation tool, and most excitingly of all, as a way of delivering insurance to billions of people who are in desperate need of risk mitigation, but have never been able to obtain insurance at a reasonable cost.

CP: Compared to banking and other financial services, would you say that the insurance market is more or less aware of these technologies and the benefits you described?

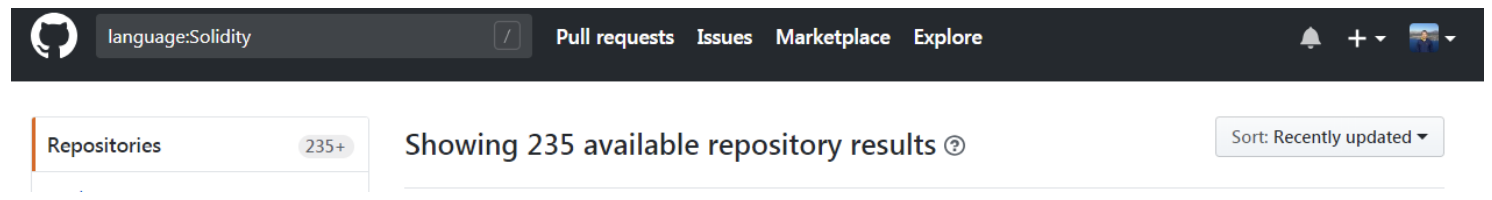

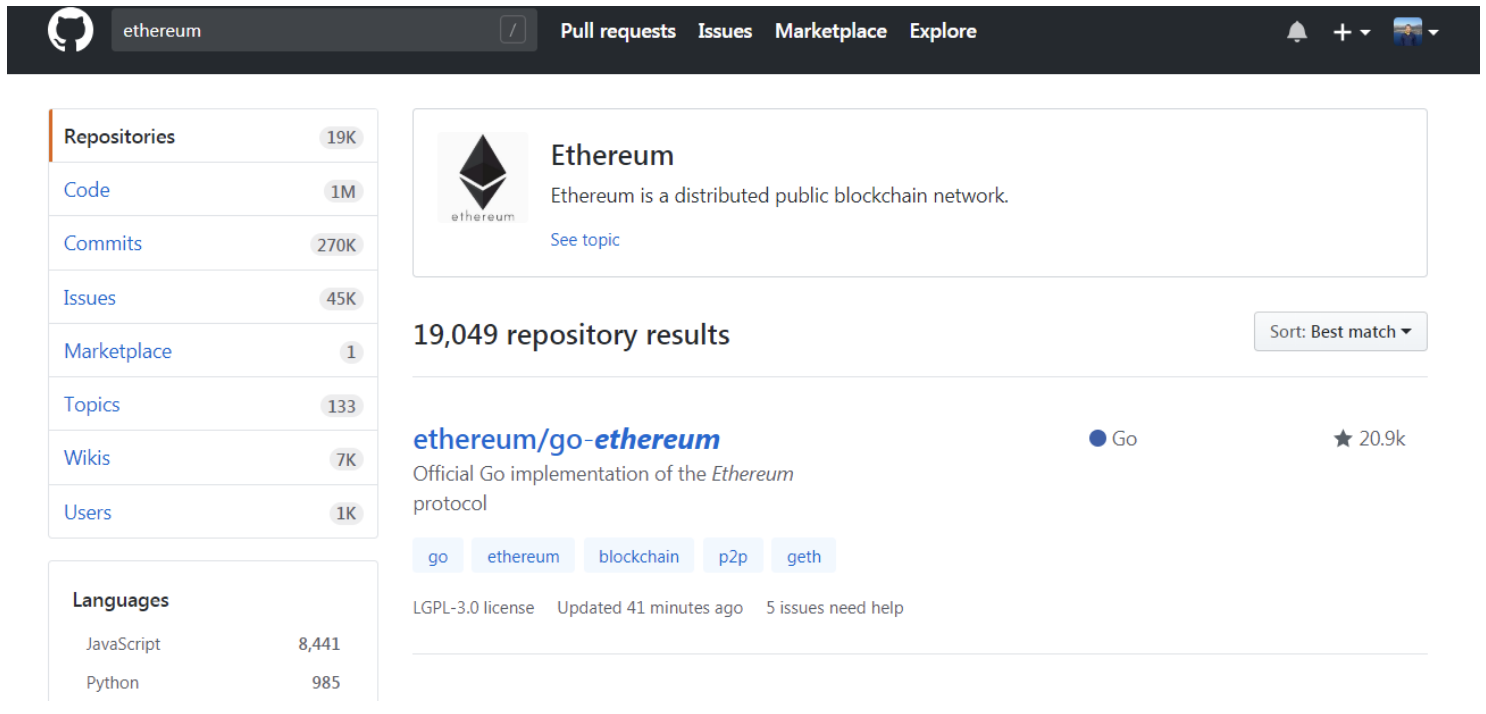

AW: Awareness of the basics of blockchain, and of DLT more broadly, has largely become mainstream; insurance executives are just as aware of its potential as leaders from most other industries. Technical expertise is likewise becoming less difficult to come by; blockchain is quite elegant as a solution and is surprisingly easy to code. But there are two main challenges in bridging the gap between a conceptual understanding of blockchain’s potential and kicking off the technical implementation of a defined solution.

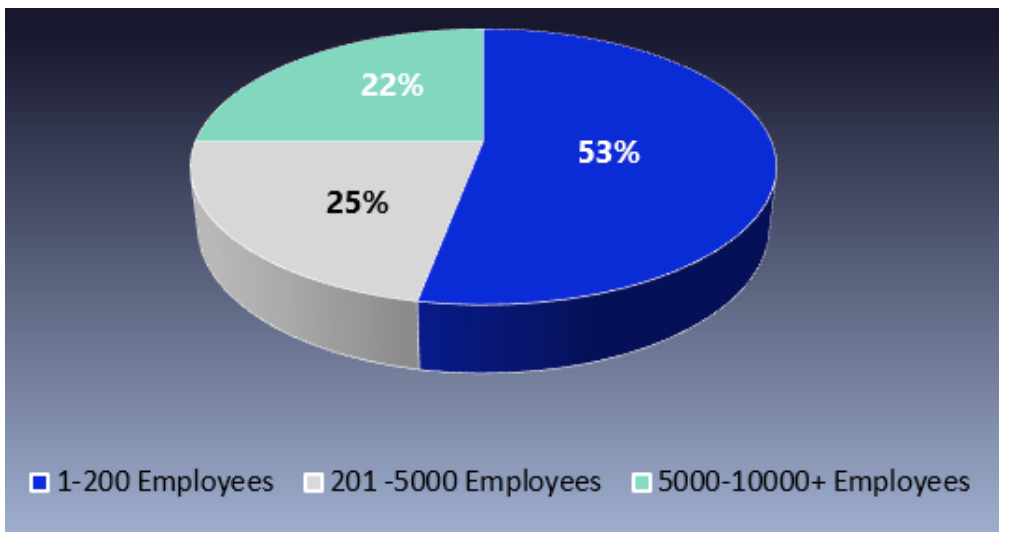

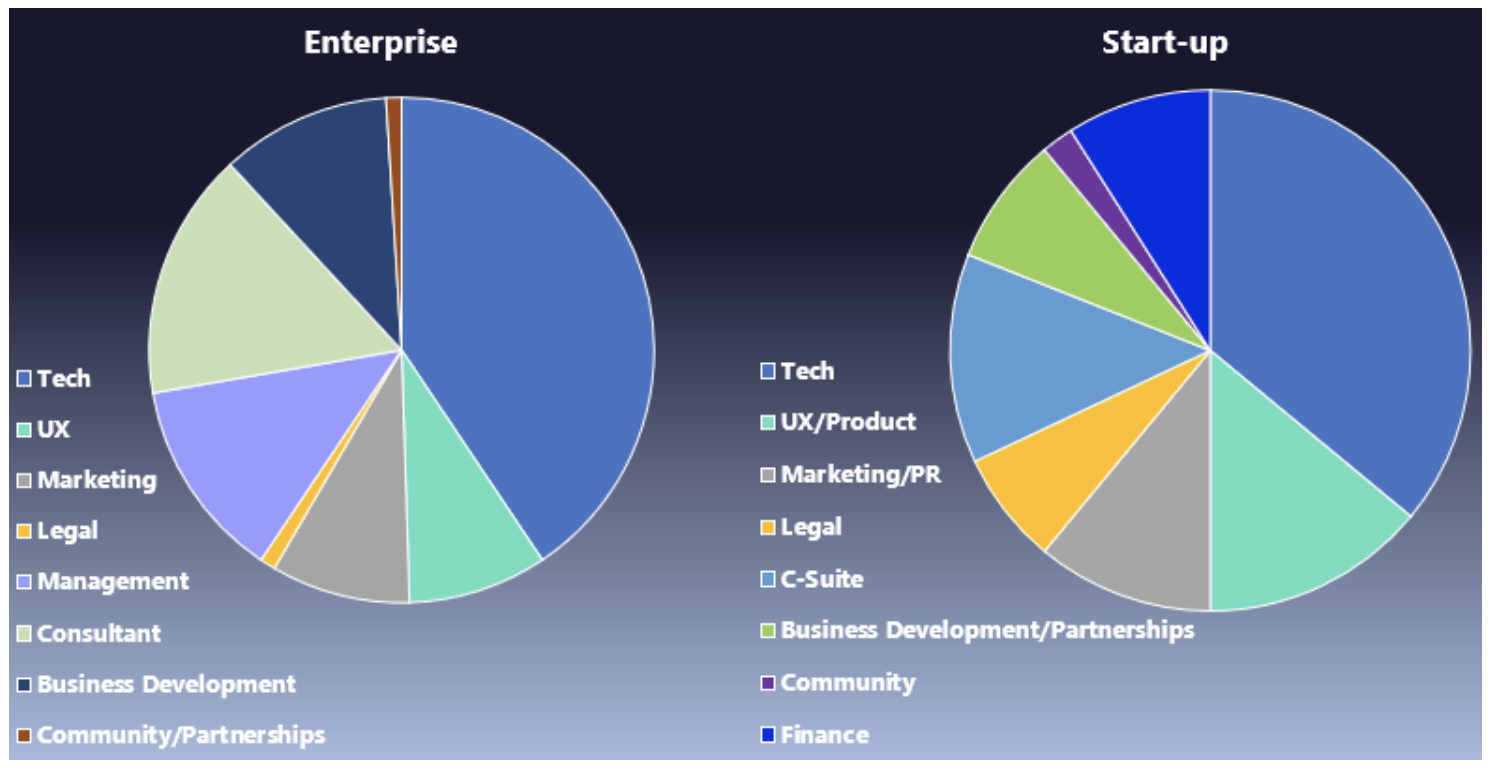

1. Articulating a business case for blockchain can be extremely challenging. This is due to the fact that adopting a DLT solution effectively means embracing a completely distributed business model. Distributed business models are new, and there are very few reference cases upon which delivered business benefits can be articulated and measured. And while it might be getting easier to find programmers who can build blockchain solutions, finding someone who can help write a good DLT business case is still quite difficult.

2. Stakeholder engagement for DLT projects is even more difficult than for other projects. Inadequate stakeholder management is already the main source of failure for IT projects in general and causes far more problems than any technical issues. With DLT solutions, by definition you are dealing with multiple parties, so instead of getting commitment from a single organisation, you have to secure commitment throughout the delivery life cycle from multiple organisations to have any chance of successful solution adoption. Finding someone who is good at this is far more difficult than finding a good programmer.

Addressing these challenges was the main reason we founded Finserv Experts about 2.5 years ago and remains our primary focus.

CP: Given these challenges around moving to a distributed model, what is the insurance industry looking at doing today? Do you see the UK insurance industry as a likely leader in adopting real implementations of these technologies?

AW: Most insurance executives already understand the transformative potential of DLT; as I alluded to above, the challenge is being able to turn that understanding into a workable plan for delivering a concrete solution. But the UK is phenomenally well placed in terms of global thought leadership. A good number of the world’s most successful and innovative insurtechs are UK based, far more so than its proportional share of the global economy. This is partially due to the crucial role that London – and Lloyd’s in particular – plays in the global insurance market, and partly due to the UK’s blockchain leadership in general.

CP: You also work with other technologies, such as machine learning. How do you see blockchains and machine learning working together? What are some areas where you see potential?

AW: While the benefits delivered by blockchain and machine learning can often be complimentary, they are usually thought of as being quite discrete from one another; they might end up in a single defined solution, but the business case costs and benefits would typically be separate line items, as would the resource estimates and delivery plans. But there is one area of interest that is starting to garner significant interest: data quality. Data consistency is already a problem in most single enterprises; it becomes even harder when multiple enterprises try to share a single version of the transactions between themselves. A good blockchain solution can make much of this problem goes away, and this creates huge opportunities in the machine learning space. Organisations that agree to use a DLT solution can potentially benefit from machine learning insights driven by a far wider learning base without having to reveal confidential customer data or commercially sensitive transaction data in the process. We are starting to see this happen on a microinsurance project we have going on right now in Southeast Asia.

CP: Switching gears, we talked a lot about blockchain, but what about cryptocurrencies specifically? Are insurance companies interested in bitcoin and Ether, or is their focus restricted to blockchain technology?

AW: Some insurtechs have experimented with accepting cryptocurrency as a form of payment for their products and services, while a number of insurers – especially in the London market – have begun writing policies for coverage of cyber risks. But specific insurance coverage for crypto-denominated assets is not something I have seen significant support for yet. Adoption of digital currency – be it crypto or fiat – is inevitable but will take place over decades rather than years. As of now, most crypto assets behave more like speculative asset classes than they do like currency, and increasingly they are coming to be regulated that way as well. This consolidation of treatment is likely to make it easier for insurance companies to offer crypto-related products by providing patterns upon which they can define and price those products, but it is still early days.

CP: Crystal ball, what does 2019 look like for blockchain technologies?

AW: 2019 will be an exciting year for DLT. A number of significant, global enterprise scale DLT solutions are scheduled to go live this year. Most of these will fail, as is the case with any new IT solution. But the few that succeed will provide a pattern which both investors and implementers will use to gain increasing competence and confidence to start gaining tangible benefit from the incredible potential that DLT has to offer.

CP: Wow, I’ve been hearing that ‘go-lives’ are scheduled for “next year” for the last few years. I am pleasantly surprised to hear that we’re moving forward and brave enough to schedule them for this year now. Thank you very much for sharing your insight and expertise. I wish you all the best in 2019.

AW: Thank you very much. All the best to you and your readers too.

Please let us know what you think. Where are the benefits of DLT? Where are the opportunities? Is this the year we go live? Which other industries would you be interested in hearing more about?