Crypto Ratings Council

- Posted: 10.10.19

Colin Platt here again, time for another blog, exploring some of the topics that Zeth, Shaun and I found interesting.

On the 30 September, several of the largest and most prominent US-based companies in the cryptocurrency space, including Coinbase, Kraken, Circle and Genesis, came together to announce the launch of their latest initiative, the Crypto Ratings Council.

The members of the Crypto Ratings Council believe that they found an opportunity to offer further clarity to companies working with digital assets, with regard to their treatment under US laws. To this end they developed the Asset Rating Framework (the “Framework”) which specifically focused on the likelihood that a US Federal court may find specific digital assets to be classed as securities under the benchmark “Howey Test”.

This test comes from a landmark 1946 court case, whereby it was decided that an instrument could fall under rules that would require that they, amongst other things, need to register as a security. This test is comprised of four factors: “(i) whether crypto purchasers invested money, (ii) in a “common enterprise”, (iii) with a reasonable expectation of profit, (iv) based on the efforts of others.”

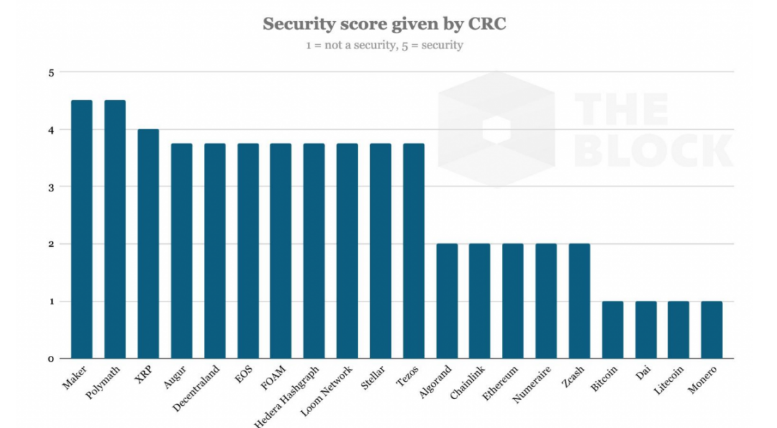

Looking at the four components of the Howey Test, the Framework is used to assign a ranking of 1 (least likely to be a security) to 5 (most likely to be a security). The Crypto Ratings Council does not rate all tokens and does not release the names of tokens which it determined to have a 5 ranking.

The Block investigated the initially released ratings, which showed that Maker, Polymath and XRP were all rated as more likely to be considered securities:

Bitcoin, stablecoin DAI, Litecoin and Monero, however were seen as the least likely to satisfy the Howey Test.

It is worth noting that on the day that the ratings were released, the US Securities and Exchange Commission (which governs securities registration in the US) announced a settlement with EOS issuer Block.one, which alleged that the EOS ICO had been an unregistered securities sale. The Crypto Ratings Council had rated EOS a 3.75, on par with Augur, Decentraland, FOAM, Hedera Hashgraph, Loom Network, Stellar and Tezos, and less than Maker, Polymath and XRP.

Ether, the native token of Ethereum, was rated a 2, suggesting that it was more likely to be considered a security than Bitcoin, but still relatively low. Details for this were not made public, but some have speculated that ETH 2.0 and a move to PoS may have prompted an increased score.

Legal experts have commented that the release of these ratings, while a positive sign that such companies are conducting due diligence, could have negative repercussions, including attracting unwanted attention. It’s hard to say if, or how a court might use the Crypto Ratings Council Framework if one of the rated projects was challenged.

Given the SEC action it is unclear whether the Crypto Ratings Council will amend their Framework.

What we can draw from this, is an appetite from many involved in the cryptocurrency space to have clear cut guidance on challenges facing them, including regulatory treatment. This is perhaps not a surprise, given their desires to build new things which may not always neatly fall into an existing bucket. However, for that same reason, it may also be difficult to offer such guidance in a useful manner.

As always, nothing here should be construed as financial advice, recommendation or endorsement of any project or cryptocurrency.