Cryptocurrencies and all that drama…..

- Posted: 20.05.19

Reggie Fowler, Bitfinex, Tether Funds, IEOs

FinCEN, MSBs, Crypto Jumps

We didn’t start the fire…

Colin Platt here again, so it’s been a busy few weeks for cryptocurrencies, hasn’t it? Rather than a deep-dive, we thought it would be helpful to recap some of these things just to help map it out.

By far, the biggest story –which was actually four stories in one– centred around Bitfinex and Tether parent company iFinex.

To explain this one, we have to go back a little way to October 2014 when Tether was launched as “Realcoin”. The goal of Realcoin was to offer a token, which used a network linked to the Bitcoin network to trade an asset backed by US Dollars held in a bank account.

One month later, Realcoin was rebranded to Tether, and announced a partnership with Bitfinex. In January 2015, Bitfinex became the first exchange to accept Tether for deposits and withdrawals from customers.

August 2016, Bitfinex suffers a hack that results in $72 million being stolen. Bitfinex spreads the losses across clients’ accounts, and delivers the BFX token to represent that loss.

Then, in April 2017, Bitfinex announces that it was repaying all BFX token holders to compensate them for the losses. Later that month, Tether announced that Wells Fargo and several Taiwanese banks were blocking transfers to and from Tether.

Whilst all this was happening, notional issuance of Tether grew from $7 million in January 2017, to $320 million in July of that year. By December it had grown to $1.3 billion+ in issuance.

Some figures in the cryptocurrency community became skeptical that Tether could offer this service at this scale whilst staying below regulators’ radars, and –pointing to evidence in Tethers’ terms and conditions as well as banking trouble– accused Tether of issuing some or all of these tokens without corresponding USD balances to back them. The goal of which, these accusers asserted, was to push the price of bitcoin up. Recall that in 2017 the price of one bitcoin (BTC) went from ~$900 in January, to nearly $20,000 by mid December. Naturally Tether denied this, and by September 2018 Tethers in issue had exceeded $2.8 billion.

Several rounds of conversations between Tether executives and the CFTC, as well as attestations by lawyers, bankers and accountants later, and rumours of surrounding Tether had not been laid to rest.

Fast forward to March 2019, Tether quietly updates their website to change the assertion that each Tether is backed by cash, to include “other assets and receivables from loans made by Tether to third parties.”

Now, last month, April 2019, two big things hit the news. The first was an announcement by the New York State Attorney General (NYAG) announced that they were investigating iFinex (Bitfinex and Tether) for fraud, including the allegation that Bitfinex took a three year loan from Tether balances to cover a $850 million hole due to bank accounts seizures by Polish, Portuguese and US law enforcement due to their link with a company known as Crypto Capital Corp.

Soon thereafter, things got more interesting, when the US Department of Justice’s Southern District of New York announced that they were charging Reginald Fowler and Ravid Yosef in connection with providing shadow banking services to cryptocurrency exchanges through a company known as Global Trading Solutions. This included charges of running an unlicensed money transmitter business. The SDNY stated in the court documents that Global Trading Solutions had ties with Crypto Capital Corp.

Legal letters between lawyers for iFinex and the NYAG later ended up revealing that the loan made by Tether, from its funds, to Bitfinex, represented 26% of Tether’s funds. While the price of Tethers fell briefly following the NYAG’s allegations, the market largely shrugged off the news.

Since the revelation of the NYAG investigation, Bitfinex announced that it had raised $1 billion to shore up capital, through an “Initial Exchange Offering” (IEO) –an ICO but done via a cryptocurrency exchange. Bitfinex’s CTO later disclosed that half of that capital had come from parent company iFinex.

Staying in the United States, and on regulators, the US Treasury’s Financial Crimes Enforcement Network (FinCEN) put out guidance last week on cryptocurrency related business models. The press release announced that “new FinCEN guidance affirms its longstanding regulatory framework for virtual currencies”.

Naturally, those involved in cryptocurrencies took a very moderate approach and considered how they were already conforming to longstanding rules… just kidding! It was mayhem on Twitter, with everyone interpreting it however they wanted. Worth noting that several of the things covered in their note hit on the topic of money transmitting, the same rules that caused a headache for Reginald Fowler.

While the document is quite technical, some highlights were that ICOs, Stablecoins, custodial wallets, some mining pools, dapps, exchanges and a host of other businesses could fall under money transmission rules. On the plus side, mixers (services that help hide transactions in a blockchain) as well as coding services aren’t likely to fall under these rules. If you’re involved in anything that looks like these, it’s worth checking that you’re complying with all the relevant rules.

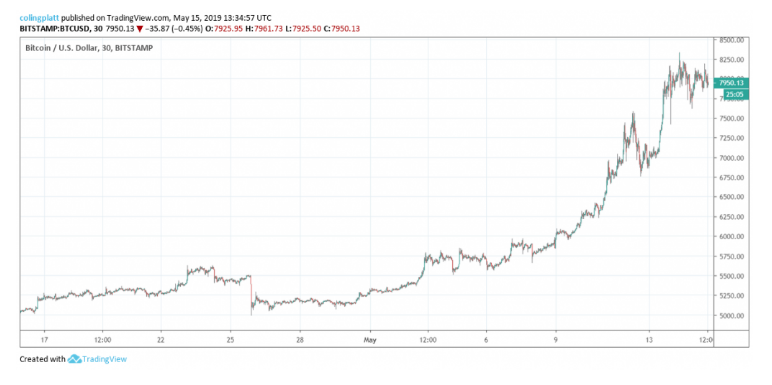

With all of this drama, objectively much of it quite negative, you would think that the price of cryptocurrencies would have continued their downward trends… Well… Bitcoin moved up more than 60% over the last month, at one point nearing $8400 on Bitstamp. Of course the move north wasn’t isolated with many other cryptocurrencies registering sizeable gains.

That’s it. Well of course there are lots of other things going on in cryptocurrencies and DLT. Stay tuned, we’ll keep following up.

As always, nothing here should be construed as financial or legal advice, recommendation or endorsement of any project or cryptocurrency.