The Russia SWIFT ban and how it will impact crypto

- Posted: 24.03.22

A few weeks in, we’re now in a position to start analyzing the effect of one of the most dramatic sanctions in recent memory – the Russian SWIFT ban.

More importantly, we’re starting to see how that ban has impacted the crypto world.

But while early hot-takes predicted one thing, the reality is shaping up to be slightly different, with some surprising lessons for crypto investors moving forward.

To get a better grasp on the issue, we’ve broken down the topic into smaller questions:

- What is the SWIFT ban, and is crypto a potential substitute financially?

- What are the current economic impacts of the ban?

- How has the crypto world responded, and what does that say moving forward?

Let’s get to it.

What is SWIFT? Can crypto bypass the ban?

You have money in an account in Bank A. You need it to be in an account in Bank B.

Prior to 1973, when you initiated a transfer, banks would use the TELEX system to describe each transaction, in detail, using sentences.

As expected, TELEX was a bit slow.

In 1973, SWIFT – The Society for Worldwide Interbank Financial Telecommunication – replaced the TELEX sentence structure with a code-based system. SWIFT dramatically increased the speed and efficiency of inter-bank transfers, and eventually became the standard system used by banks the world over.

It’s hard to overstate just how expansive the SWIFT system is; it’s currently employed in well over 200 countries, and processes over 5 billion transactions per year. SWIFT isn’t the only system out there – China has a native version, as do other countries – but it is the industry leader by a wide margin.

The Western-led ban prevented Russian banks from accessing the SWIFT network.

Inter-bank transfers became harder and more expensive, prompting all the hot takes on how Russia could or should turn to crypto networks as a workaround.

But how viable is that solution really?

Could Russia rely on crypto networks instead of SWIFT?

We’re not the only ones asking that question.

It hasn’t gone unnoticed that centralised finance worked together to cripple Russia’s monetary system, and that’s got people wondering about over-reliance on PayPal, SWIFT, Visa, Mastercard, and others.

But even without getting too deep into “CeFi vs. DeFi,” it’s one thing to argue against SWIFT et al. It’s entirely another to actually replace those institutions with crypto.

One of the best breakdowns so far comes by way of XRP and Ripple. Here’s some key takeaways from Asheesh Birla, GM of RippleNet:

- Russia averages $50 billion in foreign exchange daily

- BTC – the largest crypto network – averages between $20-$50 billion daily liquidity

- Transfer limits for the ruble on major exchanges are quite low: Coinbase allows a $200k max transfer from RUB/BTC, compared to $3.7 million BTC/USD.

The SWIFT ban highlights the continuing gap between crypto and tradfi in terms of volume. Could Russia use crypto networks as a partial workaround?

Sure, in theory. As a complete substitute? Not currently possible.

It’s also worth noting that Russia’s approach to crypto has previously been…complicated. Crypto payments aren’t entirely legal, and current legislation pending in Russia’s government makes it expressly illegal.

Switching from SWIFT to a crypto-centric system, especially if done so quickly, would require some major regulatory gymnastics.

With all that being said, there are three main current economic impacts:

1. Short-term Russian financial crisis

At this point, the outcome of the SWIFT ban and accompanying sanctions have been little short of devastating for Russia. The Russian stock market fell 39% on the day of sanctions, recovered slightly, and then promptly closed (and has more-or-less stayed closed ever since).

The ruble dived; at time of writing, it was down over 40% against the dollar. Adding in the difficulty of accessing foreign currency reserves (because of the SWIFT ban), and the Russian economy is in shambles.

2. Crypto gets caught up in sanctions

What about using crypto payments to get around the ban?

There’s a real question about how much demand there has been for crypto in light of the ban, and we’ll come back to that later.

What’s become abundantly clear is that Western governments and financial institutions expect the crypto ecosystem to enforce the ban on their behalf.

It’s the old, “clean up your own house, or we’ll do it for you” message. That’s why you get ominous press releases like this one from the EU, saying that crypto payments are “clearly” in the realm of sanctions.

3. Increasing inflationary pressure

Check out just a few commodities prices affected by the war, and you’ll see what we mean; here’s a combined chart showing crude oil prices alongside wheat prices.

Russia supplies much of Europe’s oil and natural gas, while Ukraine is a wheat powerhouse, exporting grain all around the world. Russia also exports wheat, and worldwide exports were estimated to drop by 7 million tonnes between the two countries.

The result of those increased prices is further inflationary pressure around the world.

Those are some of the short-term impacts. But what does the SWIFT ban have to say about the broader crypto ecosystem?

The SWIFT ban highlights crypto’s reliance on traditional finance:

Not the best hedge

Let’s touch on the inflation point again:

US inflation hit 7.9% in February, the highest in years. Most of that was before the Russian invasion got fully off the ground, meaning there’s worse to come when the March data comes out.

Crypto is meant to act as an inflationary hedge – at least, that’s how the typical crypto head will talk about it.

But does the data back that up?

Let’s start with Bitcoin. Global turmoil, the potential to bypass SWIFT restrictions, and increasing fiat inflation are all factors that should drive BTC higher.

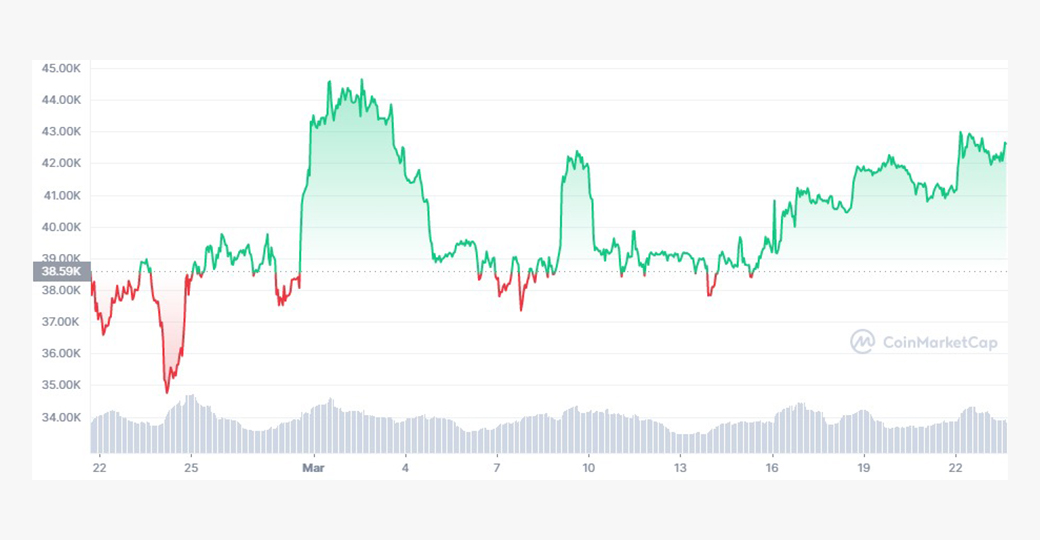

And yet, here’s BTC over the past month: essentially flat.

Ethereum? Down slightly. Solana? Down a bit more.

It gets even……

The takeaway?

Crypto might be a great hedge against inflation on the individual level, but most people don’t seem to be treating it that way. With trading volumes more or less steady and prices flat or declining, crypto isn’t responding to turmoil as we might have expected.

And that’s despite the fact that the current situation seems tailor-made to see if crypto can replace tradfi on a large scale. Russia hasn’t really even tried to use crypto to bypass the ban, and individuals largely seem to be following suit. Western investors aren’t fleeing crypto, but neither are they pouring money into it.

The upshot? Most ordinary crypto users don’t seem to be treating crypto as an inflationary hedge.

In fact, there’s even more to it than that:

With crypto markets down slightly since the beginning of the war in Ukraine, and without a mad rush to pour money into crypto as a hedge against inflation, one conclusion is becoming more and more clear.

Like traditional finance, crypto likes stability

There’s a lot of talk about crypto as the great disruptor. DeFi will grow bigger and bigger, eventually turning institutional finance obsolete. Cryptocurrencies will become dominant, largely replacing fiat currencies. This is a whole new world, powered by the immense potential of crypto.

Instead, what we’re seeing is a new and improved system that operates in many ways very similarly to the old one. Investors prefer a stable trading environment, and governments expect compliance with their rules.

That’s probably the clearest outcome of the SWIFT ban: making clear to all that the crypto world is still largely centralised.

The crypto ecosystem is still dependent on tradfi as an on/off ramp. The two systems are joined at the hip.

Banning access to one system (the SWIFT ban) doesn’t result in huge demand for the other. They work together, not as opposites.

xe.com

xe.com tradingeconomics.com

tradingeconomics.com tradingeconomics.com

tradingeconomics.com coinmarketcap.com

coinmarketcap.com