5 Tips For Investing In Crypto Projects

- Posted: 14.09.22

In the middle of a crypto winter, is it really the best time to think about cryptocurrency investing and building your crypto assets?

Yes! In fact, there’s no better time to fine-tune your method for picking the perfect project.

Think about it:

When the market picks up, there’ll be a fresh wave of new projects and digital assets to choose from.

I’ve found cryptocurrency a good investment if you time it well (which is easier than it sounds).

You need to know “How can I start crypto investing?”

And these 5 tips will start you on the right path. I use these myself – and I’ve felt the pain when I didn’t.

Let’s get right into it:

1. Check out the founding team

When dealing with cryptocurrency investing, it’s important to start at the top.

Who’s on the founding team? This is a natural starting point to analyse new projects or digital assets. But you’ve got to go deeper than mere name recognition.

Instead of just checking how many followers the founding team has on Twitter, ask yourself these three questions:

1. Are the founders mature?

We’re not talking about their fondness for uni antics. What’s their depth in the field? Have they been around the block, or are they jumping head-first into an advanced DeFi project?

Not every good founder has a huge list of accomplishments, but previous projects can tell you a lot. Speaking of that…

2. What’s their track record?

It’s almost as important to look at failures as successes. Are you seeing low-floor NFT project after NFT project? Has the founding team bounced from project to project?

Is the founder Do Kwon?

Ok, bad example. But you get my point – what sort of track record do these people have?

Once you’ve answered those first two questions, here’s the final one:

3. What’s their expertise?

Again, you’re not just looking at expertise in crypto assets. That helps, but the field is still young – no founders are going to have a string of crypto successes over the course of a 20-year career in the space. Instead, look for expertise in other fields that could transfer to crypto.

Let’s take a look at Arthur and Kathleen Breitman, founders of Tezos, as a good example.

Are they mature? Arthur Breitman first posited the Tezos blockchain in 2014. The project didn’t launch until four years later. Now, the project sits at #38 in terms of market capitalization, and both Arthur (@ArthurB) and Kathleen (@breitwoman) are highly active on Twitter, continuing to post developments about the Tezos ecosystem.

Beyond that, they both offer genuine insights into crypto, digital assets and the space in general, not the WAGMI fluff you see from a lot of talking heads.

Check out Kathleen Breitman’s Fortune interview, and you’ll see what I mean.

Founders who plan long-term and stay involved are mature founders.

Track record and expertise? The success of Tezos over the past eight years speaks to the track record. But what about expertise? Interestingly, the idea for Tezos came about while Arthur Breitman worked as Vice President at Morgan Stanley. The Breitmans brought deep knowledge of financial systems, and of managing those systems, to Tezos.

Looking for a crypto winner? Check the project’s founding team. And don’t be afraid to go deep on what they bring to the table.

That’s step one to successfully invest in cryptocurrency. Once you’ve looked into the founding team, you need to:

2. Understand the value add/big idea/use case

Ask yourself: What does the project actually do?

Simple question, but the answer makes all the difference (and how quickly you arrive at that answer).

This is so important to making cryptocurrency a good investment.

Does the project have a clear use case? Is it workable now, or does it rely on future market developments before it becomes useful?

Let’s look at another real-world example:

One clear way to get a use case is to solve a problem. That’s how MakerDAO came about.

The problem: DeFi loans involve cryptocurrencies that make loan collateralization vary wildly; sufficient collateral today may not be enough tomorrow.

The solution (in part): To introduce a stablecoin, DAI, to the system.

The value-add: Organize the entire thing in a DAO – a decentralized, autonomous organization.

MakerDAO solved a current DeFi problem, giving it an instant use case. And the introduction of a stablecoin and a DAO added new elements to the project, setting it apart from other projects.

When I invest in cryptocurrency, that’s what I’m looking for in a new project. Nearly all successful projects will solve a problem with a clear use case.

All projects need their voice to be heard, and who they choose is critical to their brand:

3. Who is promoting the project?

Ah, the fun question.

Who’s promoting the project? What kind of marketing is involved? Is there genuine community involvement, or is everything pushed by a small handful of operators?

Twitter is notorious for this, with countless accounts shilling little-known altcoins (shitcoins) and low-end NFT projects. I find those projects easy to avoid, but it’s a bit more difficult when a project comes up with celebrity endorsements – Logan Paul, Paris Hilton, etc. They really can be very persuasive in getting you to invest in cryptocurrency.

Or maybe it’s not that hard, when the endorsement is Matt Damon for Crypto.com

Find and follow good influencers instead.

I like @Cobie, someone who isn’t afraid to call out bad actors and weak projects as well as highlight good ones (he called the Terra collapse, among other things).

I’m looking for voices that are reasonable, not cheerleaders who praise every project equally.

If it looks and feels like a big celebrity endorsement, be very careful.

You then have to be honest with yourself:

4. What’s your goal with the investment?

As an investor, are you looking for big yields fast, or playing the long game? Do you want steady returns with growth potential? Do you actually think you can make this cryptocurrency a good investment?

It’s important to match your goals with the project’s capabilities.

These last two ideas go hand-in-hand. You’ve got to know what you want from an investment in crypto assets, and then be careful not to get caught up in the hype.

I learned this the hard way.

When Apecoin launched, I got caught up in the hype at too much and jumped in without thinking. A disaster? No. Risky? Definitely. And what’s my goal with an Apecoin investment, anyways? Is that really a long-game play?

On the other hand, I invested in Filecoin after extensive research. There’s a clear use case (cloud storage backed with blockchain tech) and good support. It’s clearly a long-term project, and that fit with what I was looking for in my portfolio.

The final tip is the most important.

5. Ignore the above tips (hear me out)

“But Raf,” you might say, “All I did was bet big on Dogecoin, and it worked out great!”

Not much I can say to that. Even if you follow all of the above advice to a tee, there’s no guarantee it’ll work out (if it did I’d be a billionaire by now).

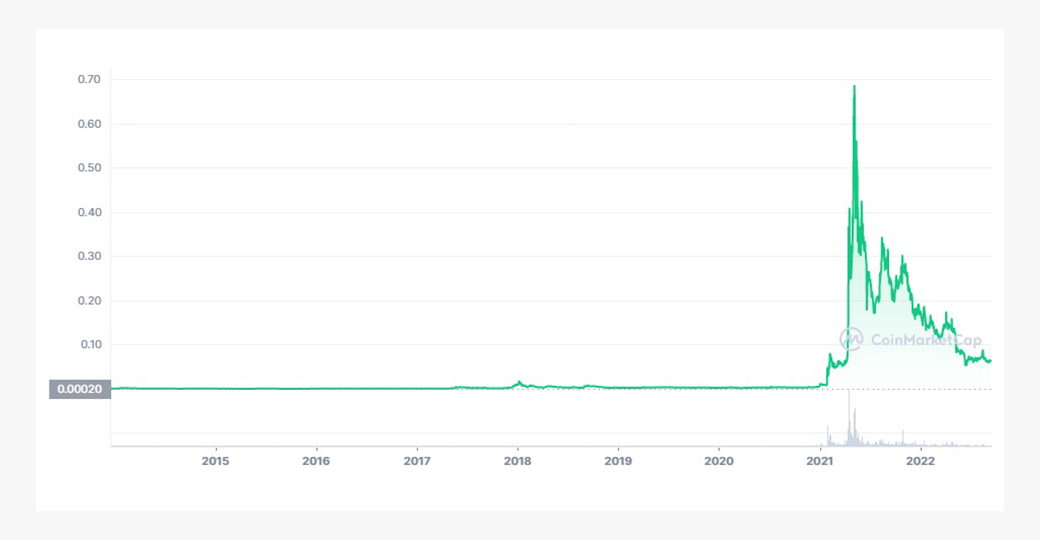

And on the flip side, memecoins like Dogecoin do occasionally work out. Doge doesn’t have a use case, the founding team is virtually unknown, and investor motivation is solely to make money. And yet, Doge is at least partially a crypto winner, with a devoted fanbase and a price that somehow avoids a complete collapse.

Dogecoin, Shiba Inu, and a host of other memecoins don’t disprove my advice. They just prove the exceptions – and you know what that means.

So if you want to be an expert at cryptocurrency investing, you need to: Deep-dive the founders, be sure there’s a use case, choose your influencers carefully, and understand your own motivation for investing.

Follow these four steps, and you’ll be on your way to picking a crypto winner.