The Ultimate Guide to creating a Web3 CV

- Posted: 26.03.24

Introduction to a Web3 CV

Here at Plexus, we see CVs every day – good ones, bad ones, and ones that need improvement.

And that got me thinking – what goes into a good Web3 CV? So I decided to ask some of the team of crypto recruiters here at Plexus to send me over their ‘best ever CV’. They all came back with the same question – ‘format or experience?’ which made me realise it was uncommon to have both… However, I secured the bag and spent some time analysing these CVs to find all of the commonalities.

Right away, I realised that many employees miss vital parts of a good Web3 CV. They tend to emphasise either experience or good formatting, but not many CVs featured both.

That led us to another insight: in a young and growing field like Web3, candidates with a great resume tailored to the Web3 industry can really stand out.

A dedicated, specialised Web3 CV can be a breakthrough tool for workers who want to jump into the exciting field of Web3, DeFi, the blockchain, and the whole evolving crypto world.

In the right hands, a good Web3 Resume:

- marks a pivotal tool for job seekers within the blockchain and decentralised application sectors

- is not merely a resume, but a showcase of one’s journey through the evolving landscape of decentralisation

- sets you apart in a competitive job market, highlighting not only your skills but also your commitment to the ethos of Web3

So after combing through dozens of the best CVs, we’ve put together a guide to the basics of any good web3 or blockchain CV. Include these elements on your next CV, and you’ll be taking the first step towards a whole new world of employment potential.

Want to get ahead in Web3? Sit down with your CV and align it with these three core elements.

Match the Three Core Elements of a Web3 CV

When they first look at an applicant’s CV, our recruiters look for three things:

- Companies you’ve worked at before

- Length of time you worked there

- Experience that matches the desired role

It might seem obvious, but the companies you’ve worked at previously and the length of time you stayed there are still the biggest elements of your CV. This is especially true as your career progresses. It matters where you choose to work now, because it will impact your future recruiting potential.

To that end, when you’re formatting your CV, you need to keep the critical information (previous work experience) easily accessible. No crazy fonts or unusual formatting; recruiters still need to see, at a glance, where you’ve been and what you’ve done.

Matching projects to skillsets is the third core element, and one that you aren’t able to control as well as the first two. Be aware that different projects will require different skillsets.

As George, one of our recruiters, says,

“I’m not likely to send someone who has been a solo marketing lead at a startup to a company with a large marketing department or vice versa as the way they work is quite different.”

Demonstrate an Understanding of the Web3 Industry

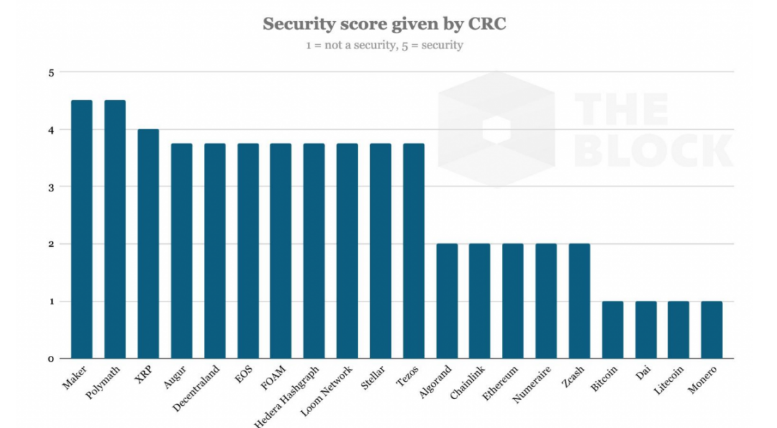

Web3 is not just about technical prowess; it embodies a shift towards decentralisation, transparency, and community-driven development. Applicants must demonstrate a deep understanding of these principles, aligning their skills and experiences with the unique challenges and opportunities of the Web3 space.

On the practical level, at Plexus we look for similarities in the role and similarities in the type of company. For example, If we are hiring for a client running a DeFi protocol we will likely look to see if you have experience in the DeFi sector, unless they are open minded to candidates without Web3 experience.

Transferable Skills for Non-Technical Positions

Beyond technical skills, Web3 values community engagement, content creation, and strategic thinking. Highlight experiences that showcase your ability to foster community, drive engagement, or strategise in a decentralised environment. These skills are invaluable in roles from community management to marketing within Web3 companies.

Experience with Web3-Focused Projects

Direct involvement in Web3 projects, whether through development, marketing, or community initiatives, demonstrates real-world application of your skills. Detail your contributions to these projects, emphasising your role, achievements, and the impact on the project’s success.

Problem-Solving Skills and Adaptability

The Web3 sector thrives on innovation and rapid evolution. Showcasing your problem-solving skills and adaptability through examples of overcoming technical challenges or adapting to new technologies reinforces your value as a dynamic and resilient professional.

This can also extend to extra-career events or skills. This candidate included several short sections in a row to highlight a wide range of interests and achievements related to their career, if not directly part of it.

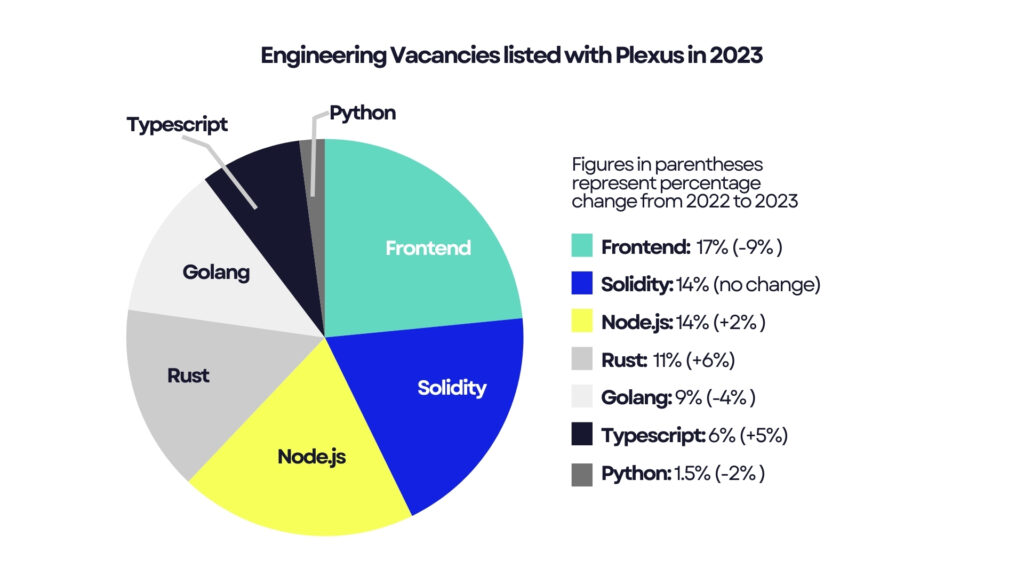

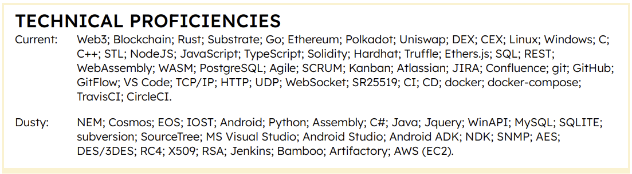

Technical Skills and Projects

For developers, a Web3 CV should list proficiency in languages and frameworks critical to blockchain and DApps, like Solidity for Ethereum or Rust for Solana. More importantly, showcasing actual projects or contributions to open-source initiatives provides tangible proof of your capabilities and dedication to Web3 technologies.

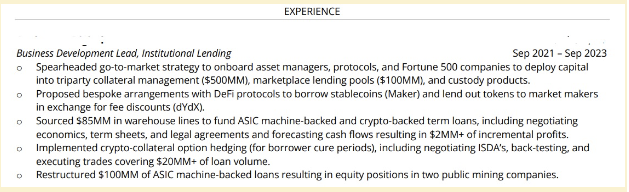

Identify a clear list of projects and outcomes. We’re not only looking for “worked at ___ as community developer” but also looking for both project and outcome.

Contrast that with the example below:

“Grew an active Telegram community at blank leading DeFi lending protocol from 500 users to 10,000 in six months.”

Right away, we learn where you worked, the kind of project (DeFi lending protocol), the general role you held (social media marketing), and key deliverables (community growth and participation).

And don’t worry if you’ve covered the breadth of the Web3 ecosystem, moving from DAOs to DeFi and on to NFT projects. A wide range of experiences can be helpful, especially if you’ve got clear deliverables to match.

Embrace Simple Formatting

Here’s your typical reminder that the “usual stuff” is a great way to stand out. Don’t forget to format clearly and cleanly. Recruiters don’t want five-page CVs full of extra info. A survey of some of the best CVs we’ve seen at Plexus show that they share some common features which you can and should incorporate into your Web3 Resume:

Look

Black text on white background, length at most 2 pages.

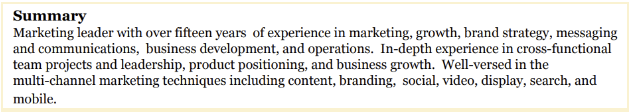

A summary (optional) – at most this is one paragraph. Some examples are third person, some are written in first person, some are neutral. The tone is less important than the length (short) and the info (lots of it).

Work experience listed as follows:

- Job title, followed by company name, followed by date.

- If the company was smaller, put in brackets what the company did / the sector; for example: LoftIQ (A fintech startup marketplace lending analytics and financial products firm)

- Each job then has bullet points which list clear achievement and stats / outcomes rather than responsibilities

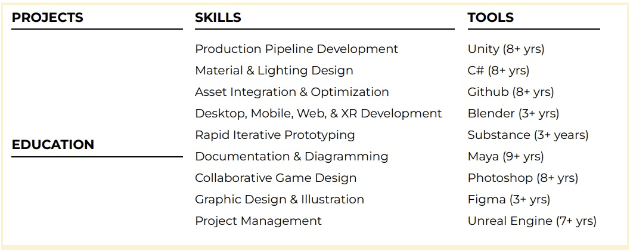

A skills section

Here’s a great example:

- Showcasing specific languages or software you have experience with

- Short education section towards the end of profile

- Included a section with any hackathons or projects they had been a part of – one short line for each. (Example: UW dubHacks 2021 Team, 2nd Place, and then a link to the project)

- Include (as bullet points) any speaking panels or awards won

Remember, whatever you do, keep it simple. That doesn’t mean all CVs should look the same; there are ways to use different formats.

But whatever you do, don’t get carried away – keep the information easy-to-access.

Extra Insights

If you’ve made it this far, you might be wondering – what about my intro?

It’s true that a typical CV usually starts with some sort of high-level summary of your career to-date:

There’s certainly nothing wrong with this kind of summary – it does deliver a lot of information quickly.

But there’s also no set requirement for it; out of the seven of our favourite Web3 CVs, three omitted a summary entirely, and one included a single sentence.

Those who did include a summary kept it short; the example above is only three sentences long. CVs without a summary just jumped straight into the meat of the matter – technical skills and work experience.

This approach has the advantage of getting recruiters to core information quickly – no extra steps required.

Conclusion

Crafting a compelling Web3 CV is about more than listing skills and experiences; it’s about telling your story within the Web3 narrative. By effectively communicating your journey, skills, and dedication to decentralisation, you position yourself as a valuable asset to any Web3 enterprise.

Got your CV up to scratch? Why not check out our jobs in Web3 + Crypto and get applying!

Written by

Sarah Akwisombe

Marketing Lead